By UBS Asset Management: Collateralized Loan Obligations (CLOs) have long been a cornerstone of the U.S. securitized products market, evolving from a niche institutional investment to a growing area of interest for broader investor audiences. As of May 2025, the global CLO market reached USD 1.2 trillion in assets, up from around USD 430 billion ten years ago.1

While the market remains largely U.S.-centric, AAA-rated CLO tranches have increasingly attracted a global investor base. Historically the domain of banks, insurance companies, and other balance sheet investors, these securities are now becoming more accessible through Exchange Traded Funds (ETFs). For European allocators looking at high-quality floating-rate instruments with potential diversification benefits, ETF structures are offering an institutional-grade entry point to the top tier of CLO capital structures.

Understanding AAA-rated CLOs

CLOs are structured credit vehicles that securitize broadly syndicated loans – typically to sub-investment grade corporate borrowers – into tranches with distinct risk-return profiles. The AAA-rated tranche, sitting at the top of the capital stack, benefits from:

- Credit enhancement and subordination that protect against portfolio losses.

- Priority access to cash flows from the underlying loan pool.

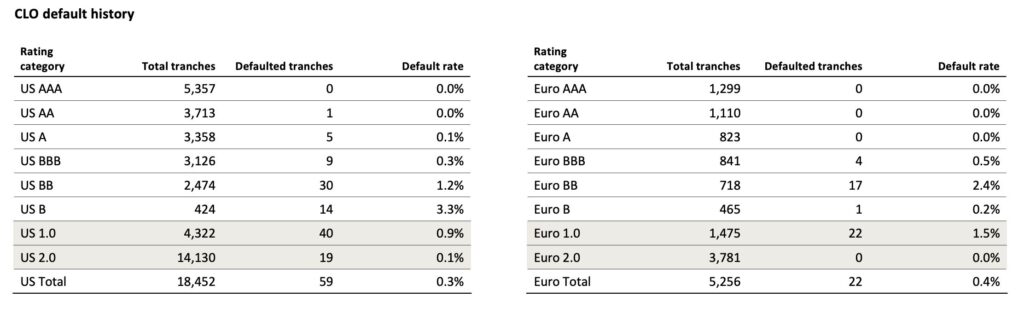

- A record of zero defaults on AAA tranches since the modern CLO market began in the 1990s.

These tranches are typically collateralized by a diversified pool of senior secured loans. The structure is designed to withstand significant credit stress, with multiple forms of credit support including overcollateralization, interest coverage tests, and active portfolio management.

Key characteristics driving investor interest in AAA CLOs include:

Floating-rate coupons – mitigating interest rate risk during tightening cycles.

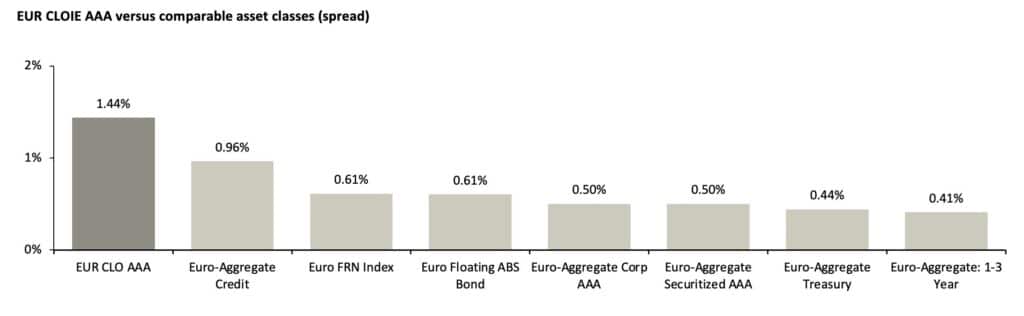

Spread premium – offering carry above comparably rated corporate bonds.

Diversification – historically low correlations with traditional fixed income and equity markets.

Structural resilience – supported by active loan portfolio management and embedded covenants.

These features have supported demand even as broader credit markets adjust to shifting rate and liquidity conditions.

Chart 1. Relative value to other asset classes

CLO ETFs: Institutional access in a liquid format

ETF structures have widened the investor base for AAA CLOs by delivering daily liquidity and transparent pricing in an asset class traditionally traded over the counter. For allocators in the Nordics and across Europe, CLO ETFs offer:

Access – opening a securitized credit segment that previously required specialist mandates or separate account structures.

Liquidity – continuous trading on major exchanges.

Cost efficiency – often lower than direct private fund or separate account structures

Diversification – exposure to portfolios spanning multiple CLO managers, vintages, and underlying loans.

This evolution reflects a broader trend of securitized credit products being repackaged into regulated, exchange-listed vehicles.

The role of active management

While each CLO is actively managed at the deal level, ETF portfolio management adds another layer of oversight. Active CLO ETFs focus on:

Manager selection – evaluating CLO managers’ track records, credit processes, and discipline in structuring transactions.

Portfolio construction – balancing exposure across managers, vintages, and deal characteristics to reduce idiosyncratic risks.

Relative value positioning – rotating between primary and secondary market opportunities and adjusting maturity profiles as market conditions evolve.

Vintage diversification is a key consideration. Spreading investments across different issuance years helps smooth performance across credit cycles. Portfolio managers may also adjust allocations between primary deals – where new issuance offers potential pricing advantages – and secondary market opportunities that can emerge during periods of market volatility.

Liquidity management is another important component. While CLO tranches are less liquid than standard corporate bonds, ETF portfolio managers use cash buffers and trading flexibility to accommodate investor flows while maintaining portfolio stability.

Market context: Why AAA CLO ETFs gaining traction

The appeal of AAA CLO ETFs is supported by broader macroeconomic and market dynamics. In a period of fluctuating interest rates and persistent inflationary pressures, floating-rate instruments offer potential insulation from duration risk.

At the same time, spreads on AAA CLO tranches have often compared favorably with other instruments of similar credit quality, such as AAA-rated corporate bonds or sovereign-backed securities. This combination of defensive positioning and potential yield pickup is a driver of increasing ETF adoption, particularly in Europe, where investor familiarity with securitized credit continues to grow.

Looking ahead: Broadening access to high-quality credit

In Europe, AAA CLO ETFs are gaining attention as investors seek high-quality, floating-rate credit in a regulated and liquid format. The combination of incremental spread potential and senior tranche credit quality positions them as a potential complement to traditional fixed income allocations.

Growth in European-domiciled CLO ETFs suggests this market segment will continue to evolve, offering institutional and professional investors broader opportunities to integrate securitized credit exposure into their portfolios.1

Risk considerations

As with all investments, CLO ETFs are subject to risk. These include credit risk, particularly during periods of market stress, as well as structural risks specific to securitized products. Actively managed ETFs may also involve manager discretion risk, where investment decisions may not align with prevailing market conditions. Investors should consider their individual risk tolerance and investment horizon before making any allocation decisions.

Chart 2. CLOs have exhibited low default losses

1 This does not constitute a guarantee by UBS Asset Management.

UBS Asset Management is a large-scale asset manager with a presence in 24 markets. It offers investment capabilities and investment styles across all major traditional and alternative asset classes to institutions, wholesale intermediaries and wealth management clients around the world. It is the largest European provider of indexed investments.

Marketing Communication. For professional investors only. Capital at risk. Not investment advice or offer. Availability may be restricted by jurisdiction. © UBS 2025. All rights reserved.