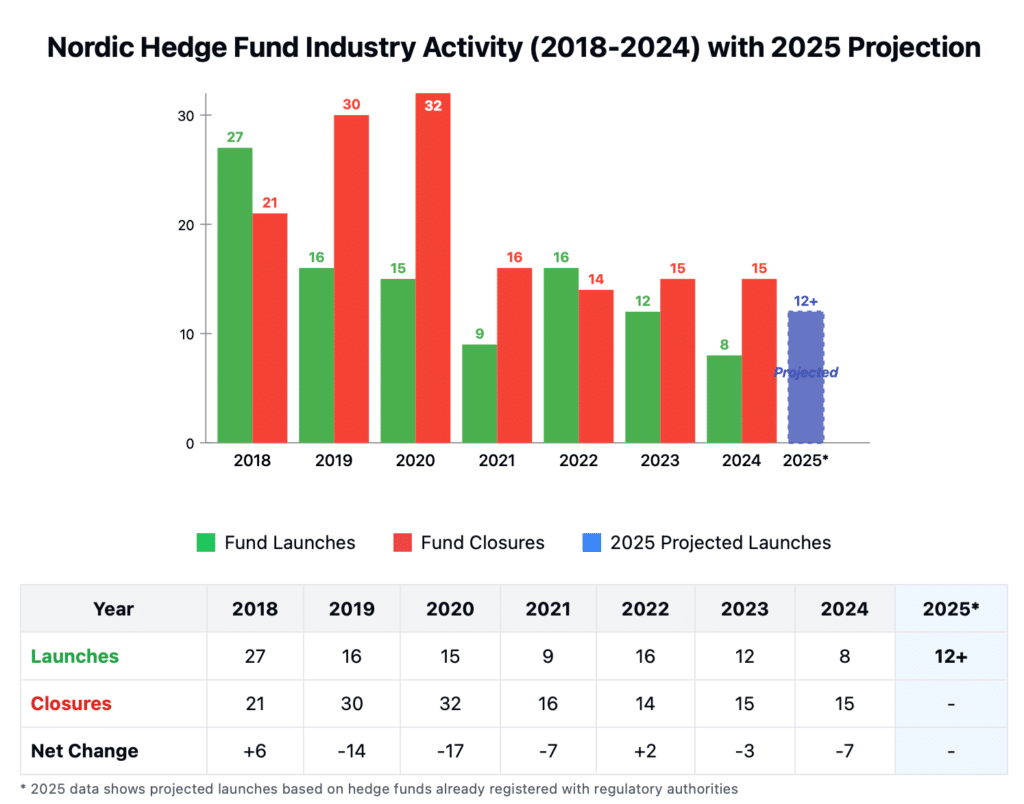

The number of fund launches and closures can be seen as a key indicator of the health of the Nordic hedge fund industry. The industry has experienced more closures than new launches over the past five years, with three funds shutting down for every two that started. While the launch-to-closure ratio improved in 2022 and 2023, 2024 saw twice as many closures as launches. This alone though does not provide a complete picture. The outlook for 2025 appears more promising, with a stronger pipeline of new funds than in previous years, as around a dozen hedge funds already registered and preparing to enter the market.

The Nordic hedge fund industry has seen a decline in the number of active funds, dropping from a peak of over 185 at the end of 2018 to around 140 by the end of 2024, with an average annual net decrease of around 8 funds. Despite this overall reduction, the industry has undergone a dynamic evolution beneath the surface in recent years. In 2018, the region experienced a strong year for fund launches, with 27 new funds coming to market. However, this momentum has fluctuated over time, with launches falling to 16 in 2019, 15 in 2020, and 9 in 2021. The pace picked up again in 2022 with 16 new launches, before easing to 12 in 2023 and reaching a low of just 8 in 2024.

Although the number of new launches in 2024 is one of the lowest HedgeNordic has recorded going back to 2015, there is a positive outlook ahead. A strong pipeline of new launches is expected to materialize in 2025, with over 10 hedge funds already registered with regulatory authorities but yet to launch. Some of these funds have already launched at the start of this year, making 2025 look promising for the industry’s growth in terms of new fund introductions.

At the same time, the number of fund closures has fluctuated, rising from 21 in 2018 to 30 in 2019, peaking at 32 in 2020, before declining to 16 in 2021, 14 in 2022, and stabilizing around 15 in both 2023 and 2024. These figures highlight the region’s entrepreneurial spirit as well as the challenges of a competitive market landscape. Ultimately, the “survival of the fittest” dynamic strengthens the Nordic hedge fund industry, benefiting end investors.

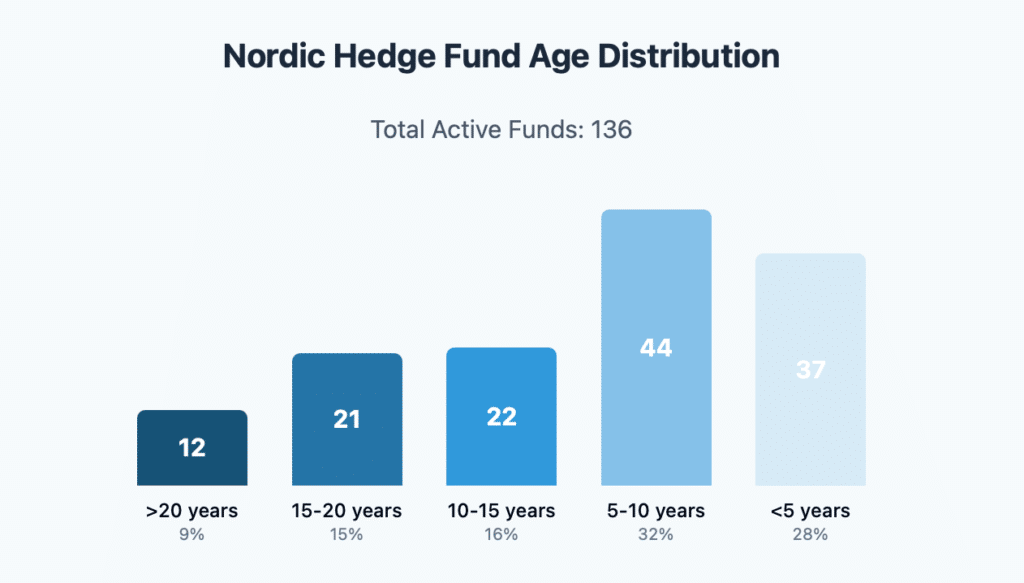

The Nordic hedge fund industry demonstrates significant dynamism in terms of launches and closures, with 60 new fund launches and 90 closures over the past five years. At the same time, there is a growing cohort of hedge funds with long operating histories. For instance, the industry boasts 55 hedge funds with a track record of over 10 years, 33 funds with more than 15 years of history, and 12 funds with a track record exceeding 20 years. Additionally, there are 44 funds with track records ranging from five to ten years.

Although recent years have seen more closures than launches, the expected wave of new funds in 2025 suggests renewed industry momentum. Coupled with a stable group of long-established hedge funds, the Nordic hedge fund industry remains resilient after enjoying one of its best ever years of performance in 2024.