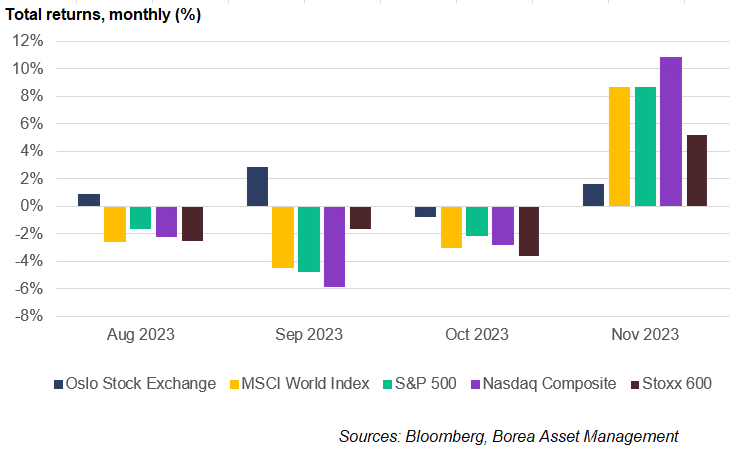

Stockholm (HedgeNordic) – Stock markets globally lost ground for three consecutive months starting in August, only to witness a recovery in November. Following a decline of 9.2 percent from August to October, the global stock market has seen an 8.8 percent rise so far in November. What has changed? “The short answer relates to interest rates,” says Magnus Vie Sundal, a portfolio manager of Norwegian fund boutique Borea Asset Management.

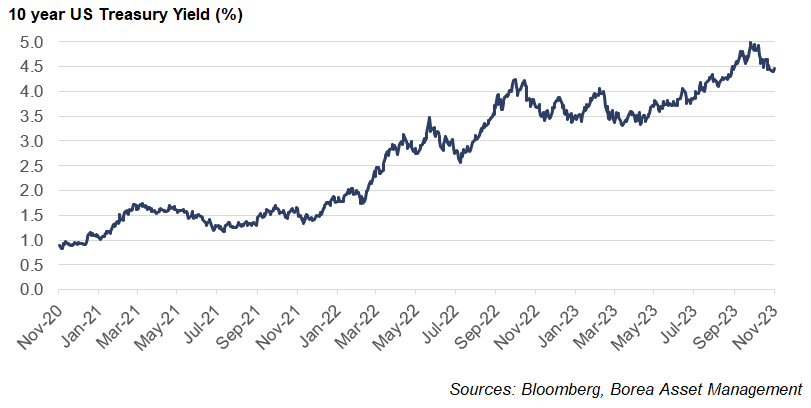

Both central banks and investors found themselves continually reassessing their inflation and interest rate expectations this summer due to various factors. “First, the U.S. economy has fared much better than expected,” notes Vie Sundal. Initial projections for a 0.3 percent GDP growth in 2023 have been exceeded, currently approaching 2.3 percent. Additionally, the price of oil rose from $72 to $95 a barrel from June to September. “Higher growth and more expensive energy made investors fear even more interest rate hikes from the world’s most influential central bank,” argues Vie Sundal. The narrative was one of ‘higher interest rates for longer,’ leading the yield on the ten-year Treasury to climb from 3.6-3.7 percent in June to 5.0 percent in October.

“When “risk-free” interest rates rise, the potential return on other investments must also increase to remain attractive.”

Vie Sundal explains that these long-term interest rates serve as an alternative return benchmark when evaluating the appeal of various investments. “When “risk-free” interest rates rise, the potential return on other investments must also increase to remain attractive,” points out Vie Sundal. This implies that, for stocks, either prices need to decrease, or profit outlooks must improve. “In addition, long-term interest rates affect how investors discount future earnings from stocks and fixed-rate bonds.”

However, in November, the narrative shifted. “Investors began focusing more on the medicine working,” highlights Vie Sundal. “Inflation is on the way down, and so is core inflation.” The latest measurements indicate a minimal contribution from commodity inflation in the United States. Inflation is predominantly driven by service inflation, with rent being the most significant contributor. Oil prices have also decreased from the peak of $96 a barrel in October to $82 a barrel today. “And while the Federal Reserve previously indicated the need for a further interest rate hike, chief Jerome Powell stated at the last interest rate meeting that increased government interest rates reduced the need for increased central bank interest rates,” says Vie Sundal.

As a result, government interest rates have fallen again, from a peak of 5.0 percent in September, to just under 4.5 percent today. “The market once again expects slightly faster interest rate cuts from the central bank,” observes Vie Sundal. Consequently, risk assets such as stocks, particularly growth stocks, have experienced a positive month in November. Looking beyond the US and the largest giant corporations, many stock exchanges and industries are no longer as highly priced, according to Borea’s portfolio manager. “Several of the world’s stock exchanges trade at lower price-to-earnings multiples than we have seen in the last 20 years,” he points out.

“The market once again expects slightly faster interest rate cuts from the central bank.”

“We can argue that stocks are not so highly priced in absolute terms,” says Vie Sundal. However, the alternative has become much more attractive. “It is not difficult to argue for an overweighting of bonds in today’s market.” Vie Sundal acknowledges the ever-changing dynamics of the market, emphasizing that the story can shift from one month to the next. Despite inherent risks, “the beauty of interest is that it is tangible and is paid ‘in cash’ today,” according to Vie Sundal. “Here, too, we find a range of risks associated with the companies to which we lend money. However, in today’s market, we can get 6-7-8 percent effective interest without taking on too much risk. We believe this is a good deal.”

On a related note, banks have reaped the benefits of higher interest rates. As of the end of the third quarter, Norwegian banks achieved a 14.0 percent return on book equity for the year, compared to 11.5 percent in the same period of last year. Borea Utbytte, an equity fund solely investing in the banking sector, has delivered a return of 12 percent year-to-date through the end of October. “As we approach the end of November, our Nordic AT1 fund investing in Additional Tier-1 (AT1) securities issued by banks, as well as our two high-yield funds have delivered good and stable gains year-to-date,” says Vie Sundal. “Borea Obligasjon, Borea Høyrente and Borea Kreditt are up approximately 8.0 percent, 8.5 percent and 11 percent, respectively, so far this year.”