Stockholm (HedgeNordic) – Institutional investors have increasingly shifted their portfolios to alternative asset classes such as hedge funds in the low interest-rate environment after the global financial crisis in the late 2000s. Finnish institutional investors, in particular, have found more space in their portfolios for hedge fund investments.

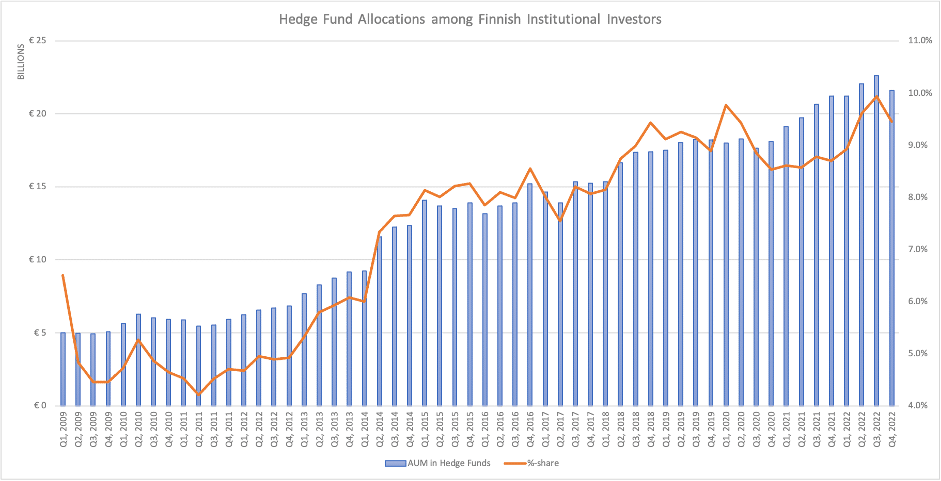

Data collected by the Finnish Pension Alliance TELA, which gives a good overview of the Finnish pension landscape, shows that hedge fund allocations have steadily increased since 2009 in a group of six of the largest institutional investors in Finland. At the end of 2009, the group – represented by Elo (born in 2014 with the merger of LocalTapiola Pension and Pension Fennia), Ilmarinen, Varma, Veritas, Keva, and the State Pension Fund of Finland – had €5.1 billion or 4.5 percent of their total investments of €113.9 billion allocated to hedge funds. 13 years later, this number nearly doubled. By the end of 2022 the group collectively held €21.6 billion or 9.5 percent out of their total investments of €228.7 billion in hedge funds.

“Hedge funds and other alternative asset classes have been used as diversifiers in the portfolio construction,” Veritas CIO Kari Vatanen (pictured center) explains the increasing exposure to hedge funds and alternatives among Finnish institutional investors. “There has been a tendency to move from the traditional equity/bond portfolio towards an endowment model type of asset allocation where alternative assets have a significant role in the portfolio,” he elaborates. One reason for this tendency has been a long period of low and even negative interest rates. “High-quality bonds have offered neither yield nor diversification to the equity markets.”

“There has been a tendency to move from the traditional equity/bond portfolio towards an endowment model type of asset allocation…”

Alternative asset classes, including hedge funds, have been seen and used as a good replacement for bonds with positive expected return and some diversification benefits, according to Vatanen. “Allocations to hedge funds have increased among Finnish pension funds in recent years, but the same also applies to other alternative asset classes like real estate, private equity, private debt, for example,” agrees Mika Jaatinen (pictured left), Portfolio Manager of Hedge Fund Investments at Elo. “This all is happening as organizations try to achieve more diversification in a market environment where correlations between stocks and bonds are turning from negative to positive.”

The appeal of hedge funds reflects the search for additional and diversifying return streams, according to Jaatinen. “Hedge fund portfolios have diversified risks in pension fund portfolios in a negative yield environment,” he explains. “Hedge funds are typically seen as ways to diversify overall allocation/return streams and to gain exposure to investment strategies that are difficult to execute in-house.”

“Hedge fund portfolios have diversified risks in pension fund portfolios in a negative yield environment.”

Markus Frosterus (pictured right), senior portfolio manager focusing on hedge funds at Keva, corroborates Jaatinen’s view. “Overall, one explaining factor for growing allocations to hedge funds is that they cover strategies and areas which are not internally managed by pension funds,” says Frosterus. The appeal of hedge funds has increased in recent years due to their substitute role for low-yielding fixed income, so what does the future hold for the industry?

Are Hedge Funds Still Attractive?

“Hedge funds have worked as an alternative for bonds or fixed income instruments, so their attractiveness in the future is dependent on their expected and even realized return compared to the bonds,” argues Kari Vatanen of Veritas. “After the massive increase in market rates, return expectations for fixed income instruments have risen significantly, which means that the relative attractiveness of alternatives and hedge funds as well might be lower than a year ago,” he elaborates. “Hedge funds can still provide diversification and even higher expected returns in the changed market environment, which makes them an essential element in the portfolio construction.”

“Hedge funds are to provide diversification and complement the traditional asset classes, as well as benefit from the occasional volatility spikes and market dislocations.”

Markus Frosterus of Finland’s largest pension fund Keva says that “hedge funds are to provide diversification and complement the traditional asset classes, as well as benefit from the occasional volatility spikes and market dislocations.” Having a meaningful allocation to hedge funds should still be at the core of most institutional portfolios. “Hedge funds have a place in the portfolios which was shown last year,” emphasizes Frosterus. The environment has been fertile for hedge fund managers in recent years and is expected to remain fertile going forward.

The Covid pandemic extended central banks’ easing mode post the global financial crisis, which “both dampened certain opportunities and also induced dislocations that were difficult to catch by traditional asset classes,” according to Frosterus. “Once the central banks turned around to tightening mode, there were attractive opportunities for credit-related funds, macro funds and CTAs, among others,” he continues. Elo’s Mika Jaatinen agrees with Frosterus, saying that “hedge funds have managed to perform as expected in the previous three years.”

The improved performance stems from several factors such as “heightened level of market volatility, higher dispersion within various asset classes and revaluation of assets due to heightened level of rates and fear of inflation,” according to Jaatinen. “All this plays well for most hedge fund strategies,” he emphasizes. Jaatinen also expects this process of valuation discovery to continue for years to come, and expects hedge funds to benefit from a higher level of interest rates as well. “It means better opportunity set not just for asset allocators but to hedge funds as well.”

Frosterus foresees a similarly bright outlook for hedge fund managers. “Various idiosyncratic opportunities seem to exist on the long and short side in corporate names, for instance, both on the equity and fixed-income side,” says Frosterus. He also believes that “volatility will raise its head from time to time to expand the opportunity set.” Similar to Jaatinen, Frosterus expects the cost of financing to stay at higher levels than people had been accustomed to, which can create pockets of opportunities for both fundamental and quantitative funds.

A Preference for International Managers

Finnish institutional investors have significantly increased the amount of capital invested in hedge funds. One might have expected the Nordic hedge fund industry to receive a boost from these flows of capital to the hedge fund space. However, “there has been a tendency to use big established international hedge fund managers in the Finnish institutional portfolios,” according to Kari Vatanen. “Local Nordic managers have stayed only as satellites to the core hedge fund portfolio.”

“Local Nordic managers have stayed only as satellites to the core hedge fund portfolio.”

Both Markus Frosterus of Keva and Mika Jaatinen of Elo argue that institutional investors compare funds side by side regardless of their country of origin. “We do not have any specific view on regional asset managers. We only have a view on individual funds themselves,” says Jaatinen. Elo, for instance, looks for funds with solid risk management and sound operational set-up.” Finnish investors have the possibility to invest in the best funds globally, according to Jaatinen, so there is no immediate need to focus on the local industry. “Overall Finnish investors are quite professional in hedge fund investing and they have long experience and good relationships with many hedge funds.”

“This is perhaps not fair for start-ups, but due to the fiduciary duties and being a bigger institutional investor, there is typically a need for the potential funds to have a certain level of assets under management and track record with top-notch operational and investment functions, among other things,” explains Frosterus. Vatanen agrees, saying that “there is also a lot of potential reputation risk for an institutional investor embedded to the hedge fund portfolio, which makes it important to select fund managers carefully and do the DD with care.”

While Sweden can boast about building Europe’s second-largest hedge fund industry in terms of assets under management, Finland represents the Nordic region’s smallest hedge fund market. “One factor is perhaps the lack of culture and relatively high business hurdles of establishing hedge funds in Finland,” explains Frosterus. “Talent pool wise, there are very good Finnish portfolio managers and analysts,” emphasizes Keva’s portfolio manager. “But they are typically hired by foreign hedge funds and other investment industries.” Finnish institutional investors still get exposure to Nordic talent. “We are invested with some international hedge funds that have portfolio managers of Nordic origin in an executive role,” says Elo’s Jaatinen.

“Hedge funds represent highly actively managed funds, where the selection of the right managers is essential in the portfolio construction process.”

“Hedge funds represent highly actively managed funds, where the selection of the right managers is essential in the portfolio construction process,” concludes Kari Vatanen. There is a lot of dispersion between different strategies and funds within each sub-strategy, so successful hedge fund investing is “not just about picking the right strategy but also the right funds within it,” according to Frosterus. “Making profitable investments is never easy and markets are more than eager to correct the ‘free lunches.’”

This article features in HedgeNordic’s Nordic Hedge Fund Industry Report.