Stockholm (HedgeNordic) – One of the categories celebrated at the Nordic Hedge Award is the most promising new launch among Nordic hedge funds. All qualified funds for the 2021 “Rookie of the Year” award were launched during the rolling 12-month period ending September of 2021.

The following funds are qualified for the 2021 “Rookie of the Year” award:

| Atlant Högräntefond | Atlas Global Macro | Borea Utbytte | FE Select |

| GRIT Innolab AI Equity Arbitrage | Incomea Steady Opportunities | Paleo Fund | Tenoris One |

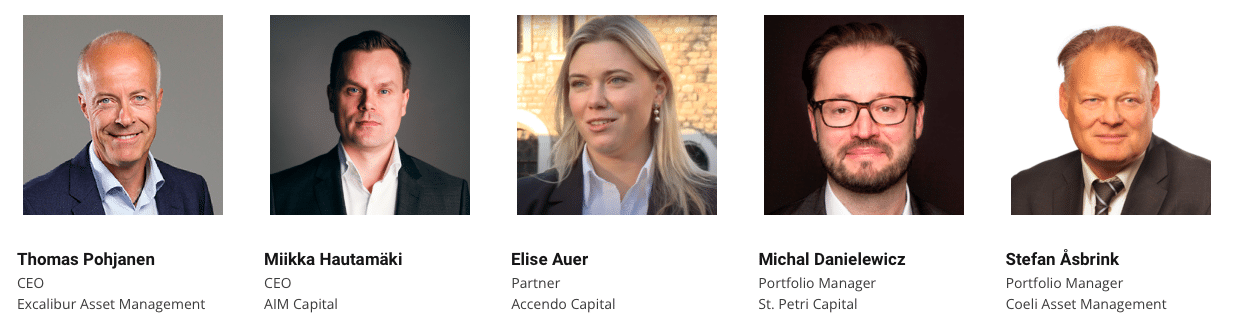

The “Rookie of the Year” is determined by the combined scoring of a jury board comprised of former Nordic Hedge Award winners and fellow fund managers, making this a peer group award. For the 2021 Nordic Hedge Award, the “Rookie” jury consists of Thomas Pohjanen of Excalibur Asset Management, Miikka Hautamäki of AIM Capital, Accendo Capital’s Elise Auer, Michal Danielewicz of St. Petri Capital, and Stefan Åsbrink from Coeli Asset Management.

The jury selects what is in their opinion the most promising hedge fund debut of the passing year by considering a host of qualitative assessments at the discretion of jury members. The jury is asked to consider things such as:

- Which of the qualifying funds would I, for my personal portfolio or for the fund portfolio/selection I am responsible for, be most comfortable investing in, despite its short track record and likely small size?

- Which of the funds is likely and positioned to build a respectable and outstanding, long-lasting and robust track record?

- Which of the funds is likely to have a meaningful impact on the Nordic hedge fund universe (potential to be “star manager,” sizeable assets…)?

- Which of the funds is positioned to be a “Billion Dollar Fund” (if that is even desired or the intention, within the capacity of the strategy)?

Hedge funds considered for the “Rookie of the Year” award of a given year are launched during the rolling 12-month period through the end of September of that year. Funds launched later than September of that year will qualify for next year’s “Rookie of the Year” award. Funds must be listed in the Nordic Hedge Index and meet the criteria required for such listing. There is no minimum or maximum requirement for assets under management to be considered.

The winner will be announced on April 27, 2022 at the final event of the Nordic Hedge Award in Stockholm. To learn more about the “Rookie of the Year” award and previous winners, please click here: Rookie of the Year.

Good luck to all contestants!

The Nordic Hedge Award is supported by these fine entities: