By Declan O’Brien, UBS Asset Management, Real Estate & Private Markets – The headlines make for formidable reading: 2Q 2020 saw record flows into sustainable funds with over USD 54bn1 raised, and the performance of ESG aligned stocks are up 78%2 year to date as investors look to re-position their portfolio post-COVID-19 and pre-regulatory changes.

This follows the broader market sentiment. In 2019, UBS Asset Management (UBS-AM) surveyed over 600 institutional investors worldwide, representing more than EUR 19tn in combined AUM and a majority said they believe environmental factors will matter more to their investments than traditional financial criteria over the next five years. These eye-catching figures predominately relate to public market activity.

Private markets also have an important role to play in sustainable investing, particularly the infrastructure market. While the private infrastructure sector was initially slow to integrate ESG best practice, the past five years have seen a rapid transformation. Infrastructure investors are finding innovative ways to measure ESG performance for an asset class which spans diverse sectors. Upcoming EU regulation and ESG-related disclosure will further accelerate this change.

“While the private infrastructure sector was initially slow to integrate ESG best practice, the past five years have seen a rapid transformation.”

Infrastructure investing covers a wide range of investments from energy and utilities, digital infrastructure, transportation and social infrastructure. Within the infrastructure sector, clean energy is the poster child for ESG-focused investors. However, other sub-sectors can also create positive ESG benefits, whether that be connecting rural areas with fiber-optic cables or providing health care services, schools and housing.

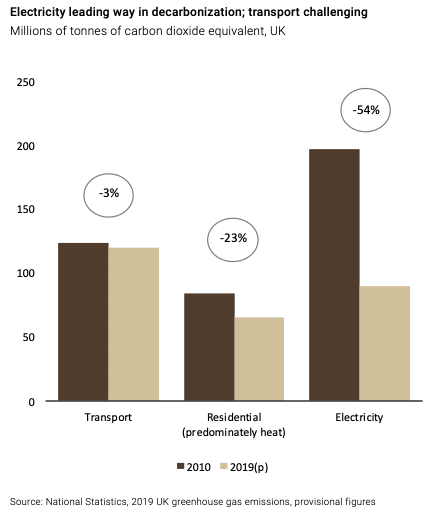

Clean energy is a large segment of the infrastructure investment universe (accounting for almost 50% of deal volumes from 2012-20193). Public support is high for clean energy and with more than 20 countries signing up for net zero targets4, the investment opportunity looks set to grow. What started as investing into renewables has extended into storage and energy efficiency investments. The decarbonization of electricity over the past 10 years has been remarkable, largely thanks to the growth in renewables and the phasing out of coal. The next wave of investment in this sector, such as hydrogen, will help to reduce carbon in hard-to-abate sectors such as heat, transportation and industrial process, significantly lowering emissions.

While the social and economic benefits of investment in transportation are clear, the emissions from the sector are sizable. What’s particularly interesting is that while the electricity sector has halved emission over the past decade in certain countries5, transportation has been stubbornly flat, aside from the short-term drop as a result of COVID-19. However, this does not mean that investments in the transportation space cannot have a positive ESG angle. If the net zero and 1.5 degree pledge under the Paris Agreement have any chance of being met, transportation needs to be decarbonized. Momentum is growing in the electric vehicle (EV) market and this will require new charging infrastructure and reinforcements to grid networks, providing a boon for infrastructure investment.

However, we cannot transport to a world that is fueled by zero carbon energy, transport and industry overnight. The key term is transition. In many industries there will be intermediary steps to reduce carbon emission before more sustainable sources are widely and economically available. In the energy sector, gas-fired generation will be critical to replace coal and support the growth of intermittent renewables until storage is competitive. In the shipping market, diesel vessels will be replaced with liquefied natural gas (LNG) vessels – reducing Co2 by around 25%6 – in the short-to-medium term until hydrogen becomes competitive. All of this needs to be financed and will be an important investment towards decarbonizing our economy.

UBS-AM is a global leader in sustainable investments with USD 41bn7 of sustainability-focused AUM and ESG has always been central to our investment approach. To overcome some of these reporting and disclosure challenges mentioned earlier, our infrastructure business was an early signature to the GRESB standards and commissioned a bespoke ESG model for our debt funds. For our new infrastructure equity fund, we took the further step of engaging ERM, an ESG-consultant to calculate the carbon footprint of our investments and set measurable ESG KPIs. Our commitment is to improve these KPIs during the holding period of our investments.

“The infrastructure sector provides a unique opportunity to access direct investments in sectors with attractive ESG fundamentals such as clean energy, eco-transport, digital and social infrastructure.”

The momentum on ESG in the traditional public equity and fixed income markets is very encouraging. We expect to see a continuation of this trend in private markets. Improvements in disclosure and transparency will make it easier for sustainability-focused investors to access the asset class. The infrastructure sector provides a unique opportunity to access direct investments in sectors with attractive ESG fundamentals such as clean energy, eco-transport, digital and social infrastructure. Furthermore, the sector has been resilient to COVID-19 to date, and the pandemic has only accelerated the attractiveness of clean energy, good broadband connection and access to quality healthcare.

This article featured in HedgeNordic’s report “ESG in Alternative Investments.”

- Morningstar, June 2020

- Forbes, Sept 2020

- Inframation database, January 2020

- The UN Global Compact Business Ambition for 1.5 °C campaign calls for businesses to do their part in limiting global temperature rise to 1.5°C in response to the global climate crisis and in order to meet the 1.5°C global warming target in the Paris Agreement.

- UK: National Statistics, 2019 UK greenhouse gas emissions, provisional figures

- Sustainability 2020, 12, 2080; doi:10.3390/su12052080

- As at 30 June 2020