By Linus Nilsson of NilssonHedge: Allocators frequently differentiate between systematic and discretionary strategies and do typically view the groups differently. In this short exposé, we will establish that the groups are less different than what conventionally believed and that there is plenty of commonalities. They often have the same goals and are often hybrids with substantial overlap in trading and decision-making approaches. There are some distinctive styles in the CTA space, but far from all managers manage money according to a pure approach.

“Allocators frequently differentiate between systematic and discretionary strategies and do typically view the groups differently. The groups are less different than what conventionally believed…”

At times, the word CTA is synonymous with trend-following strategies. But, CTAs represent so much more than a specific strategy, even if the trend following strategy is popular.

Setting the Stage

In this article, a Systematic strategy is an investment proposition that relies on quantitatively driven systems or processes that are implemented across markets using non-discretionary techniques. A Discretionary strategy is driven by the judgment of the portfolio manager to implement trading views and ideas. That is our definition, but we acknowledge that it is difficult to map a strategy to a specific flavor.

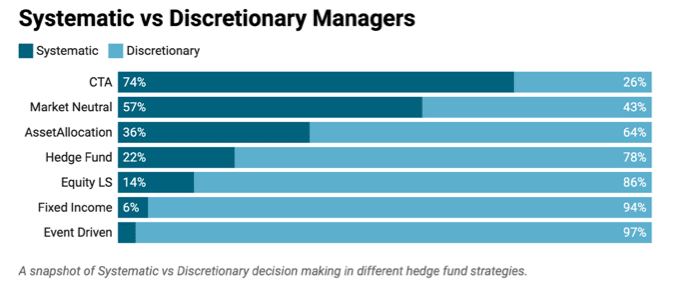

As illustrated in the graph, systematic strategies strongly dominate managed Futures managers. The supremacy of the systematic investment framework is rarely seen in other hedge fund strategies. Three out of four CTAs are driven by a systematic investment process. The closest cousin is Market Neutral strategies that are dominated by various factor-driven strategies. For some strategies, such as Equity Long/Short or Event-Driven strategies, the discretionary approach is the preferred way to invest.

In terms of assets under management, the skew is even more pronounced. An effect of allocators having associated CTAs with the large trend-following managers due to the presumption of beneficial tail risk behavior. There may also be a reporting bias as our database. The database captures strategies that are reporting numbers into the public domain and may be missing some of the more secretive Global Macro managers.

The Impact of Technology

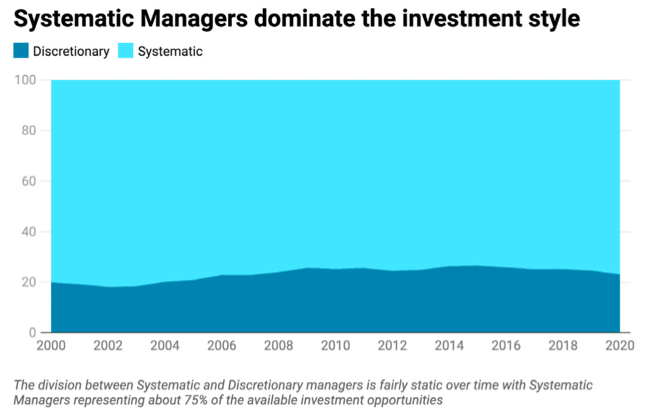

One could have formed a hypothesis that systematic strategies would gradually have emerged and come to dominate as technology evolved. Not to mention the increased capabilities to trade electronically and access to new and exciting data sources.

Headlines such as The Economist’s “March of the Machines” may have given the impression that the dominance of systematic trading strategies was a new and rapid development.

Over the last 20 years, the ratio between man and machines amongst Futures traders have not reflected any changes in technology. Innovation has not created a noticeable move.

Over time the balance has shifted marginally in favor of Discretionary managers, although this remains the smaller group. This may be somewhat surprising given the strong performance CTAs had during the Great Financial Crisis (2008/09).

Diving into the Data Pool

We continue our data journey by looking at the correlation between each of the decision-making strategies. The correlation within the two subgroups is low and perhaps lower than expected. The average cross-correlation within the two groups is 0.08 (Systematic), respectively 0.02 (Discretionary). This implies a large dispersion, regardless of investment structure.

Knowing if a manager is systematic or discretionary does not tell you if it is a good fit for your portfolio. As it seems, the diversification benefit may be larger for the Discretionary traders, but the benefit is relatively marginal from a 30,000-foot perspective. Thus, the unique style of the manager matters more than its decision-making framework.

“Knowing if a manager is systematic or discretionary does not tell you if it is a good fit for your portfolio. The unique style of the manager matters more than its decision-making framework.”

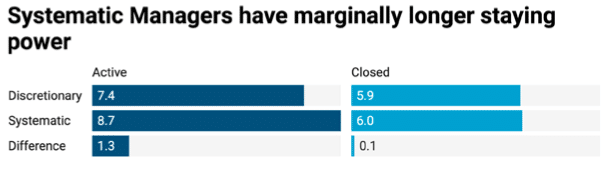

Often, systematic managers are viewed as more robust to staff changes and by extension more institutionalized. In contrast, Discretionary managers typically are more dependent on a specific key person. And thereby less potentially for long-term institutional investors.

We use the average life of closed and active funds as a proxy for process robustness (luck will presumably disappear for a larger sample). To our mild surprise, we observe that closed managers, in the two groups, have about the same life expectancy of approximately six years, regardless of the investment method. Systematic funds that are still operating, tend to have a one year longer track-record than their Discretionary peers. But the difference is relatively small.

One of the few quantitative differences that we find is that Systematic strategies tend to be better at keeping volatility stable over time. We believe that this correlates highly with the feature that most Systematic strategies incorporate risk management techniques.

Results Over Process?

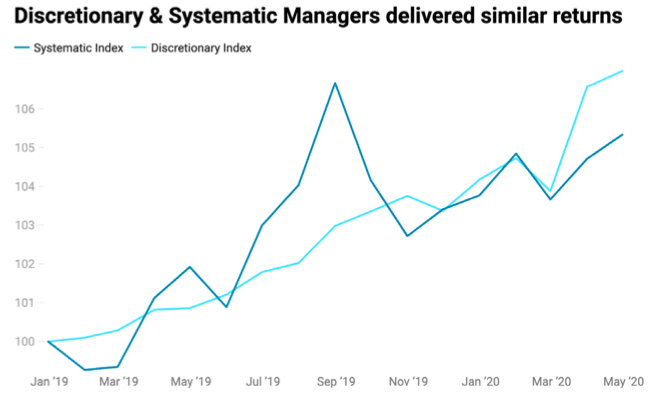

Over a tumultuous period in global markets, regardless of your underlying process, realized returns have been rather similar. Discretionary managers have come out somewhat better (and with lower volatility), using NilssonHedge’s discretionary and systematic CTA indices.

We have all learned that a repeatable and robust process creates a good outcome. But here, there is little evidence that different strategy flavors have led to materially different outcomes. Given the importance that we assert to the decision-making process, we would have expected a larger difference.

A Modest Proposal

The difference between Systematic and Discretionary investment processes is not as significant as we would like to pretend it is. It may be sold, packaged, and presented differently. But the investment strategies do have the same goal, extracting returns from another market participant in the best way possible.

“The difference between Systematic and Discretionary investment processes is not as significant as we would like to pretend it is. It may be sold, packaged, and presented differently. But the investment strategies do have the same goal, extracting returns from another market participant in the best way possible.”

A hedge fund’s client will likely take a discretionary decision to allocate to a manager. Very few systematic managers allocate to their strategies on a systematic basis. Very few discretionary managers allocate solely on their judgment. Herein lies a paradox that does not fit with our mental basis for differentiating between different decision-making frameworks.

The reality check we undertook with this article should urge investors to dig below the surface of simplistic and standardized categories to find the features they expect for their portfolio.

We want to end with a quote from the legendary trader Ed Seykota: “System trading is ultimately discretionary. The manager still has to decide how risk to accept, which market to play, and how aggressively to increase or decrease the trading base as a function of equity changes. These decisions are rather important – often more important than trade timing.”

If you have come this far, we would like to invite you to dig deeper into our data at www.nilssonhedge.com.

This article featured in HedgeNordic’s report Systematic Strategies: When Numbers are the Key!

Picture (c) beats1—shutterstock.com