Stockholm (HedgeNordic) – Wild swings across markets were the rule in the first quarter of the year. Most trend-followers got whipsawed in that environment, as they flipped from long to short or from short to long right before sudden reversals. Calculo Evolution Fund, an artificial intelligence-assisted trend-following commodity fund, sailed successfully in turbulent waters, gaining 2.7 percent in the first quarter and 2.2 percent in March alone.

Calculo Evolution Fund is one of the roughly 40 Nordic hedge funds with a positive performance for the first quarter, not the first time the Danish fund performs well in a turbulent environment. Calculo Evolution Fund held up well in the fourth quarter of 2018, too, when many trend-followers and other fund managers struggled in volatile markets. “The pure commodity focus is one reason why Calculo Evolution Fund outperforms peers” in such environments, fund manager Philip Engel Carlsson (pictured) tells HedgeNordic.

Calculo Evolution Fund ended March up 2.2 percent after costs and fees, “which highlights the fund’s objective to generate uncorrelated returns irrespective of market volatility and stress,” Carlsson writes in a letter to investors. “The global meltdown on the stock market and the extreme volatility that came with it highlights the old saying of “not putting all eggs in the same basket” and support the case for investment diversification towards uncorrelated and liquid investment strategies,” he adds.

“The global meltdown on the stock market and the extreme volatility that came with it highlights the old saying of “not putting all eggs in the same basket” and support the case for investment diversification towards uncorrelated and liquid investment strategies.”

Overseen out of the Charlottenlund region of Denmark, Calculo Evolution Fund is a trend-following fund that trades the most liquid commodities, ranging from energy, metals, and agricultural commodities to softs such as coffee, cocoa, sugar and others. The fund relies on a pre-defined set of rules to identify trading signals, as well as uses artificial intelligence to handle active positions in the portfolio.

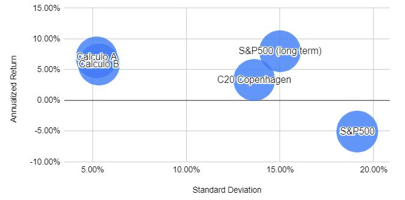

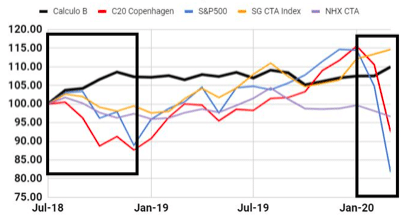

Calculo Evolution Fund generated a cumulative return of about ten percent since launching in August of 2018, corresponding to an annualized return of 5.8 percent. “This is less than expected from our backtests,” acknowledges Carlsson. However, the volatility in returns “is lower than during the test period,” he emphasizes. Calculo Evolution Fund has delivered a return comparable to the long-term annualized return of the S&P 500 since launching in August 2018, “but at a significantly lower risk.”

In addition to being uncorrelated with stock markets and exhibiting lower volatility in returns, “Calculo has also proven its ability to deliver strong performance when stock markets are correcting” as evidenced by the fund’s performance in the fourth quarter of 2018 and March of 2020.

The March Performance in Focus

March proved to be a challenging month for most investors and fund managers, as markets experienced a lot of volatility and price adjustments due to the continued spread of the coronavirus. “As Calculo Evolution Fund thrives in volatile markets with direction, we delivered a solid return on the month,” highlights Carlsson.

The Calculo team took precautionary risk management measures to deal with increased uncertainty and volatility, which tend to lead to gaps where the market opens a session significantly higher or lower than the previous session. “This could set aside the protective stop orders, and thereby increase the risk of the fund,” explains Carlsson. “As a mean of precaution, Calculo decided to eliminate exposure over weekends, where the markets are closed for a longer time period,” he says. “The outcome was less risk and a significant reduction in gap risk.”

The performance attribution analysis shows that Calculo Evolution Fund’s trades in silver, platinum and sugar contributed most to performance in March, contributing 0.81 percent, 0.77 percent and 0.64 percent, respectively, to the overall portfolio. “Gold and copper had the largest negative impact,” says Carlsson, detracting 0.59 percent and 0.39 percent from the overall performance.