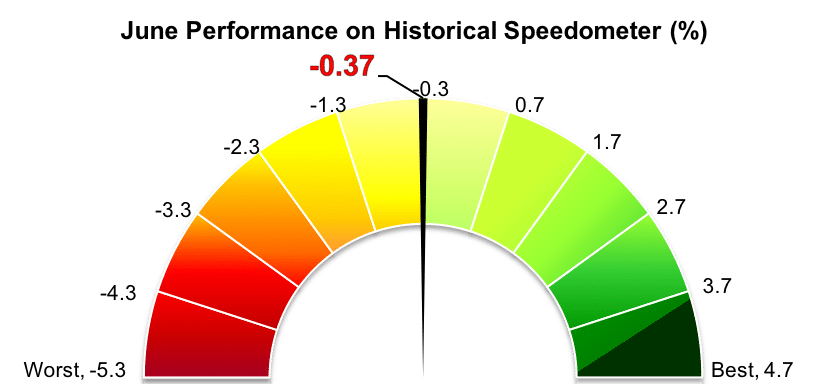

Stockholm (HedgeNordic) – Nordic equity hedge funds had a mixed performance in June, as equity markets lacked clear direction during the month. The NHX Equities Index fell 0.4 percent last month (90 percent reported), ending the first half of 2018 in positive territory at 0.7 percent.

Nordic equity hedge funds performed broadly in line with both local and global equity markets in June. Global equity markets, as expressed by the FTSE World Index, fell 0.4 percent in Euro terms last month, with equity markets trading sideways as the trade war between the United States and a number of its trading partners was developing. Eurozone equity markets, as measured by the FTSE Eurozone Index, fell 0.7 percent, whereas North American equities gained 0.6 percent in Euro terms. Nordic equity markets did not enjoy a good month either. The VINX Benchmark Index, an indicator of the overall performance of equity markets in the Nordic region, posted a negative net return of 0.8 percent in Euro terms last month.

International equity hedge funds did not fare much better than their Nordic counterparts. For instance, the Eurekahedge Long Short Equities Hedge Fund Index, which tracks the performance of 1,016 equity hedge funds, fell 0.7 percent in June (40 percent reported), cutting the gains for the first half of 2018 to 0.6 percent. The Barclay Equity Long/Short Index, meanwhile, declined an estimated 0.1 percent, with the preliminary figure calculated with reported data from 195 equity-focused hedge funds. The Barclay index gained 1.9 percent in the first six months of the year.

Less than one-third of the 58 equity-focused members of the Nordic Hedge Index (NHX) delivered positive performance in June, but there was a handful of funds which booked solid gains. Pandium Global, a value-oriented fund managed by Mikael Tarnawski-Berlin (pictured), gained 4.5 percent in June, extending year-to-date gains to 11.5 percent. The fund has gained 17.8 percent in the past 12 months and has generated a compound annual return of 13.8 percent since its inception in February 2014.

Adrigo Small & Midcap L/S, a long/short equity hedge fund investing in small and mid-cap companies in the Nordics, returned 3.9 percent in June, extending its recent run. The fund is up 6.6 percent in the first half of 2018 and has delivered a total return of 13.2 percent since its inception in November 2017. The Foghorn fund, a long/short equity hedge fund managed by Keel Capital, gained 3.0 percent last month, taking the 2018 performance further into positive territory at 5.5 percent.

Activist fund Accendo Capital, which delivered very strong performance for three consecutive years, amassed losses in the first half of 2018. The fund was down 8.5 percent in June, taking the losses for the year to 17.7 percent. DNB ECO Absolute Return and Sector Zen Fund were down 5.3 percent and 3.1 percent in June, respectively.