Stockholm (HedgeNordic) – Nordic equity-focused hedge funds, as measured by the NHX Equities, extended their average year-to-date return to 3.6% after gaining 0.5% in October (95% reported). Despite the mild post-summer recovery in performance, the average Nordic equity fund is on course to suffer the worst annual result since 2011 unless some Christmas magic rewards fund managers with substantial gains in November and December.

Nordic equity hedge funds fared worse than the overall market in October, considering that the Nordic equity market, as measured by the VINX Benchmark Index in Euro terms, rose by 1.3% for the month. Global equity markets gained 3.5% in Euro terms during October, while Eurozone equities advanced 2.4% and reached a five-month high on the back of improving economic data and declining unemployment. North American equities rose 2.3% in U.S. dollar terms (and 3.7% in Euro terms), gains driven by both encouraging economic data and third-quarter corporate earnings.

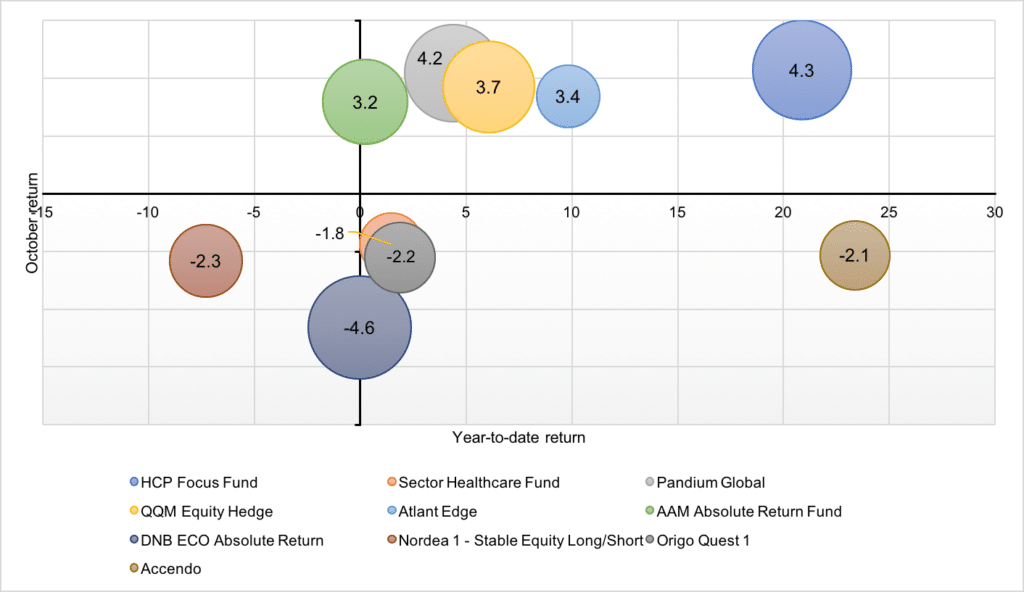

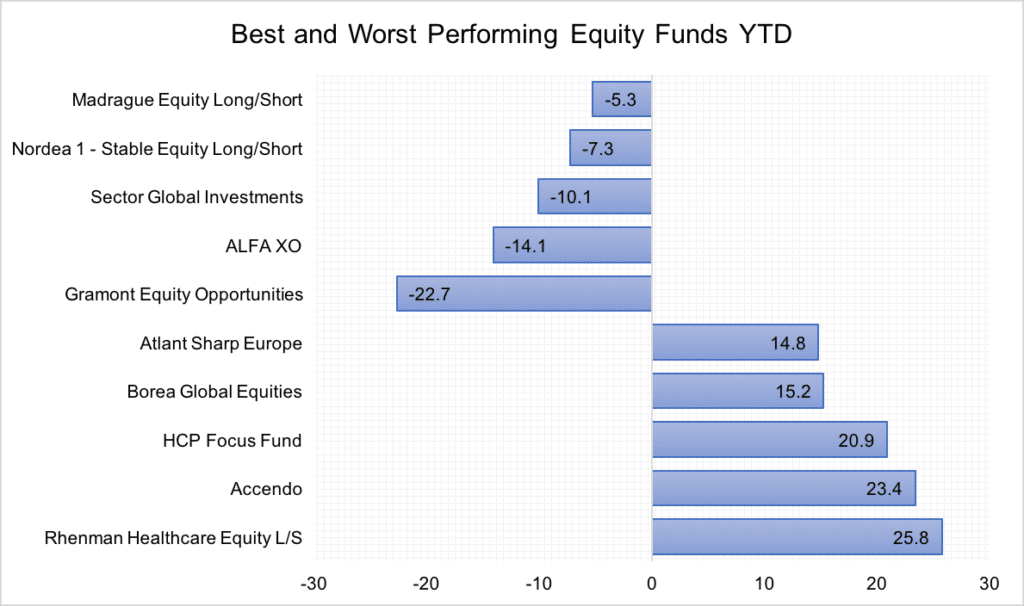

HCP Focus Fund, which manages a very concentrated and highly selective equity strategy based on the discipline of value investing, topped the list of the best-performing Nordic equity-focused funds in October, with the 4.3% return generated last month bringing the year-to-date gains to 20.9%. The value-oriented fund has produced an annualised return of 20.3% since December 2012.

Pandium Global, another equity fund following the discipline of value investing, returned 4.2% last month, bringing the year-to-date return firmly into positive territory at 4.4%. Swedish market-neutral hedge fund QQM Equity Hedge and Atlant Edge, an actively-managed fund aggressively trading equity-related derivatives on the OMXS30 Index, returned 3.7% and 3.4%, respectively. AAM Absolute Return Fund, a Norwegian long-short equity hedge fund investing in energy- and natural resources-related securities, gained 3.2% in October after returning 10.3% in September. The fund managed by Oslo Asset Management finally nudged up into positive territory for the year.

Turning our attention to the funds that lagged peers last month, DNB ECO Absolute Return, a long-short equity fund investing in the global renewable energy sector, fell by 4.6%, erasing all the gains generated in the first half of the year. Nordea’s Stable Equity Long/Short fund, small-cap specialist Origo Quest 1, and activist fund Accendo were also among those most affected by the “invisible hand” of equity markets in October. Despite incurring a monthly loss of 2.1%, Accendo retains the position as the second-best-performing Nordic equity fund in 2017.

Picture (c): Carlos-Caetano—shutterstock.com