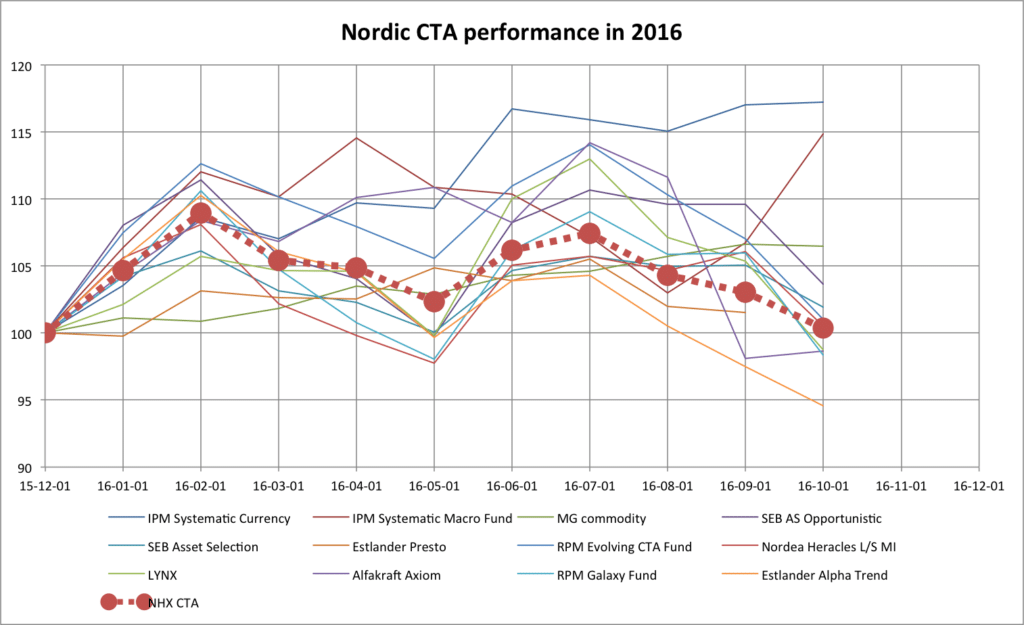

Stockholm (HedgeNordic) – Having stormed through the turbulent first two months of 2016 and again adding massive gains post Brexit, Nordic CTAs were in a good position to record solid year-to-date returns going into autumn.

However, following a stream of negative months since July, the NHX CTA Index, a composite index of Nordic CTA managers, has lost significant ground. At the end of October, the index was just mildly positive showing a year-to-date return of +0.36%. Judging from early November indications, the index is now down for the year.

So what has happened to the CTA universe? To start with, there is nothing unique with the negative numbers posted by the Nordic names in recent months. Looking at the Barclay BTOP50, which is an index tracking the largest CTAs in the world, one could argue that Nordic CTAs, in general, are outperforming their global peers. Accounting for a drop of 0.46% in November, the Barclay BTOP50 index is currently down an estimated 4.39% year-to-date.

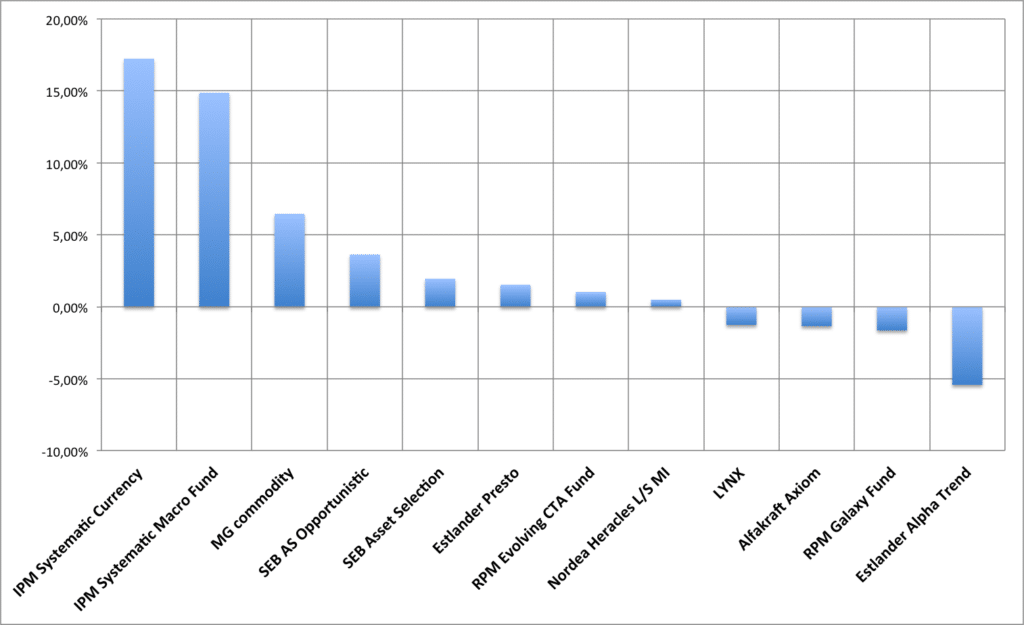

Looking at what underlying strategies that are suffering, it is clear that trend following managers, particularly those incorporating shorter-term components, have been hit particularly hard. One example is the Alfa Axiom fund that lost more than 12% during the month of September alone. But programs like Estlander Alpha Trend and LYNX, also partly using short-term trend following systems, have been hurt badly in recent months.

Systematic programs using a relative value approach rather than price momentum as main input have outperformed during the year, at least judging from the Nordic universe. The two programs from IPM, Informed Portfolio Management, are having a stellar year so far with the IPM Systematic Macro being up 14,9% end November and the IPM Systematic Currency being even better with net gains of 17.2% for the year.

The only commodity-focused CTA reporting to NHX, MG Commodity, has also done relatively well during the year. At the same time, commodities has not been the easiest of sectors during the year, at least not for trend following strategies.

The full year returns for the NHX constituents, as of end October, are displayed below, apparently performance dispersion remains significant.

Having read through the monthly commentaries from the Nordic CTAs for the month of October, it is obvious that the recent up-tick in interest rates has been plaguing managers, as a consequence, fixed income exposures have come down rapidly. Another sector that has been hurting trend followers is metals, precious metals in particular, while the currency sector has seemingly been a positive contribution.

It remains to be seen how CTAs will navigate the turbulent waters post the Trump presidential win. One would guess that managers and CTA allocators alike are longing for another Brexit move in order to end the year on a positive note. So far, markets are not pointing to a major risk-off regime shift, rather the opposite.

Let us see how the coming days play out.

Picture: (c) MR.LIGHTMAN1975 – shutterstock.com