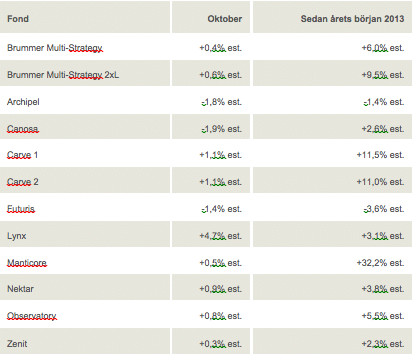

Stockholm (Hedgenordic.com) – Oktober månad gav en blandad utveckling för Brummer-fonderna. Flera steg marginellt, några tappade mark – och en återhämtade sig rejält. Totalt sett blev oktober en positiv månad, där Brummer Multi-Strategy – som är en kombination av alla singelstrategier – steg 0,4%.

På den positiva sidan hittar bland annat nytillskottet Carve med en uppgång på 1,1%, vilket ger goda 11% för helåret. Övriga fonder med uppgångar under oktober är Manticore, upp +0,5% och som därmed landar på smått fantastiska 32,2% för innevarande år, Nektar (+0,9%, 2013: +3,8%), Observatory (+0,8%, 2013: +5,5%) och Zenit (+0,3%, 2013: +2,3%).

Svagare gick det för den marknadsneutrala Archipel (-1,8%, 2013: -1,4%) och Futuris (-1,4%, 2013: -3,6%).

Månadens återhämtning står den trendföljande CTA-fonden Lynx för. Uppenbarligen har modellerna kommit på rätt spår där oktober månad slutade med en uppgång på goda +4,7%, vilket återigen tar Lynx över nollstrecket med ett resultat på +3,1% för 2013. Månadsresultaten har varit volatila för fonden. Återstår att se hur fortsättningen blir.

Bild: (c) kk-artworks—Fotolia.com