Fed Turns to Unlimited QE. Time for the Next Gold Rush?

Stockholm (HedgeNordic) – Gold may be yo-yoing just like everything else in turbulent market environments, but there is still a long-term investment case for holding the yellow metal as a strategic safe-haven asset. “You need an asset that stores value and that cannot be diluted like fiat currencies due to central banks ramping up the printing presses”, says Mattias Gromark (pictured), who manages the precious metals-focused fund Pacific Precious.

“We have just entered the third financial crisis of the 21st century after the burst of the dot.com bubble in the early 2000s and the subprime crisis in 2008,” notes Gromark. The response to each of these crises has been an injection of more debt into the financial system. “Instead of implementing proper reforms to solve the underlying problems of the global economy, the ailing infrastructure and our addiction to fossil fuels, we pump in billions of new money to plug the holes in a ship that is massively overloaded with debt already,” he argues.

“Instead of implementing proper reforms to solve the underlying problems of the global economy, the ailing infrastructure and our addiction to fossil fuels, we pump in billions of new money to plug the holes in a ship that is massively overloaded with debt already.”

The global economy might muddle through this incoming recession by injecting more debt in the system, “but this will not come without a cost,” considers Gromark. “The value of paper money must and will continue to lose value compared to hard assets.” As renowned hedge fund manager Ray Dalio puts it, “cash is trash.” Cash may well be king in the current market environment, acknowledges Gromark, “but you cannot hold cash for the long term when the money printing gains speed.” Gold is one place to park capital, but so are companies set to benefit from higher demand for gold and other precious metals.

Pacific Precious

Gromark, a former Naval Officer in the Swedish Armed Forces, manages a multi-strategy fund that provides exposure to the price development of precious metals such as gold, silver, palladium and platinum. Pacific Precious “aims to offer diversified exposure to gold and precious metals over the whole spectrum,” explains the fund manager. “Now, when gold is most likely to be in a multi-year bull market, we want exposure to both the metal itself and high-quality companies sitting on the asset.”

“Now, when gold is most likely to be in a multi-year bull market, we want exposure to both the metal itself and high-quality companies sitting on the asset.”

Pacific Precious currently allocates half of its portfolio to exchange-traded commodities backed by physical assets in the precious metals sector. The other half of the portfolio is comprised of high-quality public companies active in the mining, exploration or funding of exploration projects in precious metals. “It is important for us that all our investments have as much exposure to the physically-backed precious metals as possible,” emphasizes Gromark. On aggregate, Pacific Precious currently maintains an exposure of 75 percent to gold, ten percent to silver, and an additional ten percent to platinum and palladium. About five percent of the portfolio sits in cash.

As “we aim to catch the long-term trends in precious metals,” Pacific Precious employs a long-term-oriented, long-biased approach to investing. “That can change when the market outlook changes,” highlights Gromark. The fund has a long-time horizon for its investments, with the holding period “hopefully lasting as long as the currently-shaping bull market in gold,” says the fund manager. “But of course, we reallocate and tweak positions as market conditions change, and adjust our equity holdings depending on how they develop.”

Gold as Safe-Haven Status

Gold’s status as a haven asset has certainly been questioned by some recently, as it has been whipsawed alongside other asset classes in the recent market turmoil. Gromark, however, is confident that gold can cement its safe-haven status in the longer term. “During more normal market pullbacks, gold and stock markets tend to move in opposite directions,” says Gromark, adding that this divergence “is good for improving an investor portfolio’s risk-return profile.”

Sometimes however, “particularly when panic strikes financial markets, all assets start to correlate and move in tandem.” The increased correlations apply to “all risky assets when investors are in need of cash.” Gold failed to act as a safe haven in the vicious market moves of late February and throughout March, with Gromark suggesting that “a combination of too much leverage among gold-related leveraged products and investor need for cash to cover margin calls” put downward pressure on the price of gold. “When banks send margin calls to their clients in a market panic, you sell what you can.”

Forward-Looking Perspective

“It has been quite popular to dismiss the benefits of gold in portfolio diversification,” reckons Gromark, who adds that “many investors see the metal as an outdated asset and do not hold any gold in their portfolios.” Bitcoin and other exotic alternatives have been preferred instead. However, “adding gold to a traditional portfolio can increase risk-adjusted returns,” argues Gromark. The allocation to gold in investor portfolios is low. Based on some estimates, “the price of gold could rise in the range of $2,000 to $3,000 per ounce if all portfolios added a one percent-allocation to gold.” The price of gold is “very sensitive to an increase in demand because of the flat or even declining supply.”

“Adding gold to a traditional portfolio can increase risk-adjusted returns.”

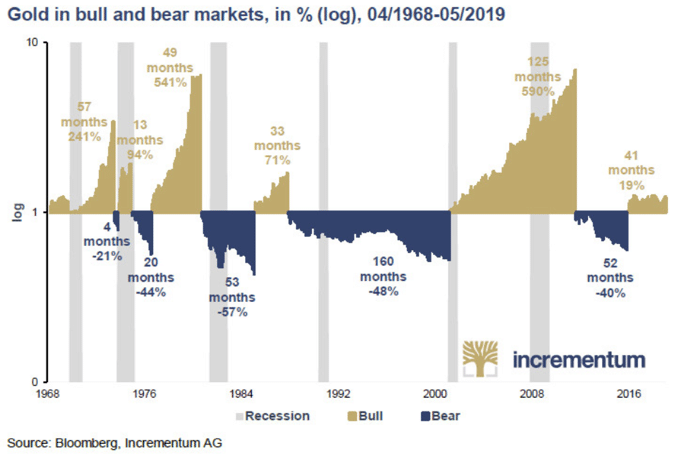

Regardless of whether investors add gold to portfolios or not, “one must realize that the debt problem the world faces will not go away, especially in the United States,” warns Gromark. “The money printing will go on, but the trust in the U.S. dollar will be questioned at some point.” Investors, therefore, need an asset that stores value. “If history is any guide, the bull market for gold has a long way to run,” says Gromark. The current bull market is still in its early stages.

Gromark’s outlook for gold and other precious metals is optimistic, and so is his outlook for companies active in the mining, exploration and funding of mining projects in precious metals. “This segment may have hit a rough patch because of excessive leverage and a need to raise cash fast,” acknowledges Gromark. “When the dust settles, companies in this sector will most likely have a good shot at increasing earnings.”

Last year’s fourth-quarter earnings for the gold mining sector were up 60 percent year-over-year. Gromark expects the same outcome for the first quarter of 2020. “Few sectors will exhibit earnings growth in the coming quarters,” so investor interest in gold mining companies and other related companies will increase. “Pacific Precious offers the whole package” allowing investors to capitalize on a long-running bull market for gold, says Gromark, “with both exposures to the metals and the best quality names in the precious metals business.”

This article featured in the Nordic Hedge Fund Industry Report 2020.