They Might be Giants

Stockholm (HedgeNordic) – In mid-September 2016, Stockholm-based Länsförsäkringar launched their one and only multi-strategy hedge fund set to be run on a mandate by Peter Fitzgerald from global asset manager Aviva Investors. During the summer of this year, however, two of Länsförsäkringar’s own portfolio managers – Martin Axell (pictured left) and Sebastian Hallenius (pictured right) – took over management responsibility for Länsförsäkringar Multistrategi and revamped the strategy with a competitive awareness of “we can do this better, and cheaper!”

“Our strategy is completely different from Aviva’s,” Martin Axell tells HedgeNordic. “We took over the management of the fund in June of this year, and during a period of two weeks, we reshuffled the old portfolio by selling everything and built an entirely new one with new positions.” Länsförsäkringar Multistrategi seeks attractive risk-adjusted returns at only a third of the equity market risk, which implies an expected annual volatility between 3 to 5 percent. Whereas the fund does not have a specific return target, a Sharpe ratio of one is a target the duo is striving to achieve.

Risk-On, Risk-Off Strategies

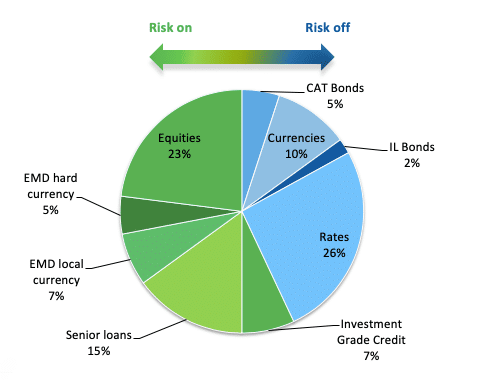

Länsförsäkringar Multistrategi’s new investment approach “tries to offer as smooth a ride as possible” by simultaneously getting exposure to market risk premia – good sources of returns in risk-on environments – and implementing defensive strategies that protect capital in risk-off environments. As Hallenius explains, “we try to find a balance in the portfolio by having exposure to different market betas and at the same time, minimizing drawdowns through the use of defensive strategies.”

Equities, senior corporate loans, emerging market debt issued in hard and local currency, and investment-grade credit are the primary sources of market risk premia for Länsförsäkringar Multistrategi. “To extract the market risk premia, we maintain a global portfolio comprised of equities and credit investments,” says Axell. The exposure to equities comes from global minimum volatility strategies, as duo expects low-risk stocks to perform well relative to the broader market on a risk-adjusted return basis.

At the same time, Länsförsäkringar Multistrategi incorporates “defensive strategies that have a positive expected return in risk-off events and are uncorrelated to traditional assets” according to Hallenius. Catastrophe bonds, insurance-linked bonds, safe-haven currencies such as the U.S. dollar or Swiss franc, and interest-rate instruments such as Swedish covered bonds generally populate the fund’s portfolio of defensive strategies.

The combination of risk-on and risk-off strategies is designed to enable the fund to deliver high risk-adjusted returns at a third of the equity market risk. “We are financial engineering to offer as smooth a ride as possible,” emphasizes Hallenius. As Axell summarizes, “the risk-on and risk-off strategies are two distinct parts of the portfolio, with the risk-on part expected to deliver returns both in the long- and short-run.” At the same time, Länsförsäkringar Multistrategi attempts to protect the portfolio with risk-off strategies. “If equity markets go down, you have the other part of the portfolio doing well; they balance out,” emphasizes Axell.

Dynamic Allocation and Unique Features

Hallenius and Axell rely on “an economic-cycle-aware framework to dynamically allocate” across various strategies and asset classes. “The allocations depend on our views on financial markets and the optimization of downside protection,” explains Hallenius. “Our framework of how we view return assumptions is very macro-regime-dependent,” he says, further adding that “we have done a lot of research to see what type of returns we should expect in different regimes.” The allocations are usually tweaked once a month, and more significant revisions are performed quarterly, “but if we have a strong view in one way or the other, we act instantly,” says Hallenius.

Länsförsäkringar Multistrategi has several features differentiating the fund from other players in the industry, with one such feature being the exposure to CAT bonds. CAT bonds are often structured as floating-rate bonds and can be viewed as a bet against severe insured losses from natural catastrophes. “If there are lower-than-expected insurance pay-outs related to catastrophes, these bonds perform well,” explains Axell.

Länsförsäkringar Multistrategi offers daily liquidity, whereas CAT bonds usually do not. Therefore, “we offer exposure to a strategy that is very idiosyncratic for investors in UCITS funds,” points out Axell. “Warren Buffett is a big investor in this space as well,” points out Hallenius, who attended the Berkshire Hathaway annual shareholders meeting several years ago with Axell. “It is such a nice risk-return type of asset,” reckons Hallenius, who adds that “it is really awesome that we can invest in this type of asset and offer private investors the possibility to get exposure to such an asset through our fund.”

Commenting on the ideal market conditions for Länsförsäkringar Multistrategi, Hallenius says “in the low interest rate market we are currently in, investors are pushed out of traditional safe assets due to low return expectations. We offer a quite attractive alternative without much added risk in our fund for those investors.”

The fund is designated for Länsförsäkringar’s own clients, initially. However, Axell and Hallenius are quite aware that some of their peers and direct competitors have had tremendous success in attracting assets to similar strategies. Aviva Investors Multi-Strategy (AIMS) managed to gather €12 billion to the strategy, Insight Investment attracted €7 billion for their Broad Opportunities Fund, Aberdeen Standard raised €20 billion to their GARS fund and not too far from home, Nordea Stable Return is running fuelled by €15 billion. It is early days yet for Länsförsäkringar Multistrategi, but, indeed, the aim is to grow from the SEK 500 million it manages today and attract some of their peers’ assets by “being just better”. Who knows, there might just be a new giant awakening in the Nordic hedge fund space.