Nordic CTAs Stumble Again in Risk-Off Environment

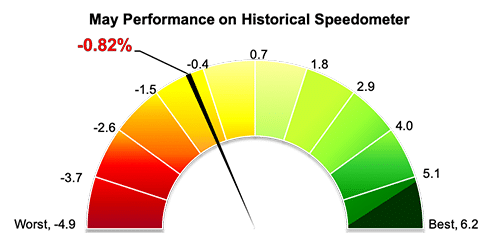

Stockholm (HedgeNordic) – Following a three-month run of positive performance, Nordic CTAs fell 0.8 percent on average in May (94 percent reported). The aggregate performance of Nordic CTAs remains in positive territory for the year at 0.5 percent.

The NHX CTA, which currently comprises 18 constituents, outperformed the world’s largest CTAs last month but trailed the broader CTA industry both in May and year-to-date. The SG CTA Index, which tracks a pool of CTAs selected from the larger managers that are open to new investment, declined 2.4 percent last month. The SG CTA Index, which includes three members of the Nordic Hedge Index, gained 2.2 percent in the first five months of 2019. The Barclay BTOP50 Index, which also tracks a select group of large investable CTAs, was down 1.7 percent last month, cutting the year-to-date performance to 3.2 percent. The broader Barclay CTA Index, which includes over 500 CTAs, was down 0.3 percent last month and gained 2.2 percent year-to-date through the end of May.

Five of the 18 members of the NHX CTA posted positive return for May. Estlander & Partners Alpha Trend II, a higher leverage version of systematic medium-term trend-following fund Estlander & Partners Alpha Trend, was last month’s best performing member of both the Nordic Hedge Index and the NHX CTA with a monthly gain of 12.6 percent. The double-digit increase brought the fund’s performance for the year back into positive territory at 0.3 percent.

Estlander & Partners Alpha Trend followed suit with a gain of 4.0 percent, which took the fund’s year-to-date return to 0.8 percent. RPM Evolving CTA Fund, a diversified multi-CTA fund, gained 3.0 percent in May as “smaller diversifying strategies managed to navigate the crisis-ridden market environment much better” than larger trend-following managers. Trend-follower Nordea 1 – Heracles Long/Short MI Fund, set to merge with another Nordea fund this month, and SEB Asset Selection were up 2.2 percent and 0.5 percent, correspondingly.

Photo by Nathan Dumlao on Unsplash