In Depth: Risk Management

Stockholm (HedgeNordic) – In our December and January in-depth series, HedgeNordic will be looking at the various layers of risk management for alternative investments and hedge funds. On purpose, we kept the topic wide to cover the different angles from operational risk, trading risk, currency hedging, reputational risk, compliance and regulatory risks, the various aspects of trading risks, such as leverage and many more. We also revisit commonly used risk metrics and question their significance, both in an academic and practical framework.

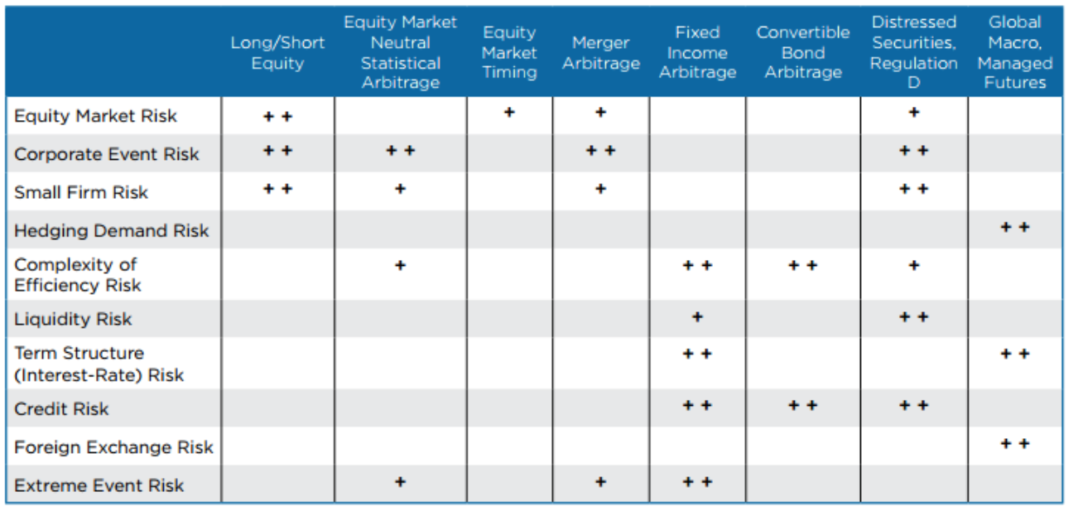

Broad risk types are described in a findings matrix developed by Lars Jaeger and Patrik Säfvenblad, two alternative investment managers and financial theorists, who define the different risk exposures by hedge fund strategy. (See Figure 1 below)

We look forward to extending the series throughout the next weeks with valuable guest contributions, expert opinions, research and whitepapers as well as HedgeNordic´s own editorial content. Don´t risk missing it!

Picture: (c) By-Robert-Kneschke—shutterstock.com