Markets Come Crashing Down on CTAs Again

Stockholm (Hedgenordic) – It has been a wild ride for the CTA industry in 2018. What started as a promising move in January, where managers built risk-on positions following a strong equity market run in late 2017, quickly turned into one of the worst months ever experienced for some of the momentum-based strategies in February. Among Nordic CTAs, Swedish industry giant Lynx were one of the hardest hit with a month-to-date loss of 14 percent (see previous Hedgenordic story).

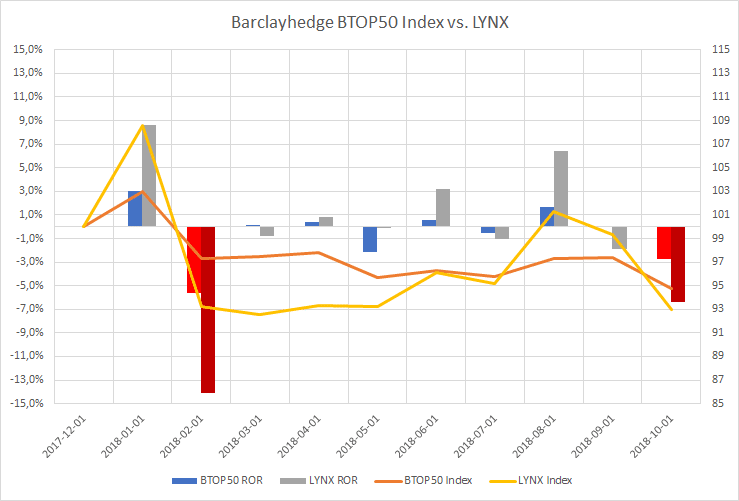

Since the February sell-off, CTAs had managed to recover most of the losses for the year going into the month of October (Lynx turned to positive for the year in August). However, a similar reversal to that experienced in February, although not as violent as measured by the increase in volatility, once again caught momentum-based strategies off-guard.

Long positions in equity indices, long energy positions, long USD exposures and short precious metals all contributed to losses as a concerted sell-off across asset classes had managers suffering. By mid-month October, performance for the year was again solidly in negative territory. Comparing the returns for the widely used CTA-benchmark Barclay BTOP50 with Lynx shines some light on the development so far this year. The two sell-offs are marked in red and dark red (for Lynx).

Among Nordic CTAs that have reported mid-month numbers for October, there is no doubt that the month has been challenging, to say the least. The worst performer up until October 12 is the RPM Galaxy Fund which was down over 18 percent, translating into a year-to-date loss of 25.5 percent. The RPM Evolving Fund was down 6.5 percent and is flat for the year. Lynx shed 6.4 percent being down close to 7 percent year-to-date. SEB Asset Selection suggests a monthly loss of around 2 percent, judging from numbers from Avanza.

The short-term trend following CTA Alfa Axiom did relatively well on the month being down an estimated 0.8 percent as of October 15, although still down 1.4 percent on the year.

In a comment to the events in October, RPM writes in a note to investors:

Going into October, the largest positions in both of our funds were; long equities (US, Europe and Japan), short US bonds (positioned for continued rising yields) and long European and Japanese bonds (positioned for falling yields), long USD and long energies.

On October 10, equities fell dramatically, the price of US bonds turned higer and energy prices slumped, meaning all our major positions went against us. On October 11, these moves continued but spread further to precious metals and currencies. Although our funds are diversified across sectors, there were few positions offering protection dfuting these days (a so-called correlation spike).

RPM concludes the note saying that they remain optmistic about the prospects for CTAs based on the readings of their indicators suggesting a turning point in business sentiment adding to political uncertainties. The increased level of volatility is also seen as being supportive in the longer term as low volatility regimes generally offer fewer opportunities for CTAs.

Picture (c): 2jenn-shutterstock