Nordic CTAs with Sweet Gains in June

Stockholm (HedgeNordic) – Nordic CTA funds, as expressed by the NHX CTA Index, gained 1.1 percent in June (95 percent reported), with the group ending the month as June’s best-performing NHX sub-category. The NHX CTA Index returned a negative 2.1 percent in the first half of 2018 (read more details).

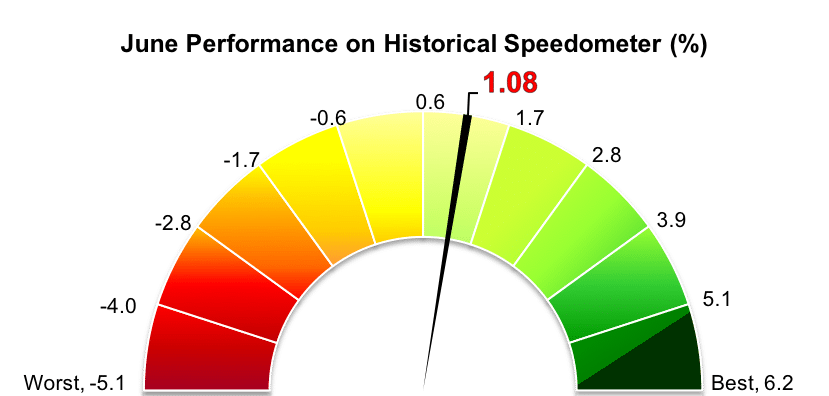

International CTA programs as a group trailed their Nordic counterparts last month. The Société Générale CTA Index, for instance, gained only 0.5 percent in June, cutting the losses for the first half of 2018 to 4.7 percent. The SG CTA Index tracks the performance of the largest 20 CTAs by assets under management. The Barclay BTOP50 Index, meanwhile, was up 0.6 percent last month, bringing the first half-year performance to a negative 3.6 percent. Rather similar to the SG CTA Index, Barclay’s BTOP50 Index reflects the performance of the 20 largest investable trading advisor programs. The broader Barclay CTA Index, designed to broadly represent the performance of all CTA programs in the database maintained by BarclayHedge, fell an estimated 0.1 percent in June, extending the losses for the first half of 2018 to 2.0 percent.

The majority of the members of the NHX CTA Index delivered positive performance in June, with 14 of the 21 members ending the month in the green. Alfa Axiom Fund, a systematic trend-following CTA fund under the umbrella of Alfakraft Fonder AB, was June’s best-performing CTA-type fund in the NHX with a gain of 10.2 percent (read more details). This solid performance put Alfa Axiom back into positive territory for the year. The fund is up 5.2 percent in the first six months of 2018.

SEB Asset Selection Opportunistic gained 3.7 percent in June, putting an end to a four-month run of poor performance. The fund, which exhibits the highest risk level among the three SEB Asset Selection funds, is down 12.6 percent in the first half of 2018. The trend-following fund run by Lynx Asset Management, Lynx (Sweden), advanced 3.2 percent last month, cutting 2018 losses to 3.9 percent. Runestone Capital Fund and Volt Diversified Alpha Fund gained 2.9 percent and 2.7 percent, correspondingly.

Aktie-Ansvar Trendhedge, a hedge fund employing a systematic trend following strategy, and two funds managed by Estlander & Partners did not enjoy a similarly good month as their peers. Aktie-Ansvar Trendhedge was down 2.9 percent in June, extending 2018 losses to 6.0 percent. Estlander & Partners Alpha Trend Program and Estlander & Partners Freedom tumbled 2.5 percent and 2.0 percent, respectively.

Picture: (c) Marian-Weyo—-shutterstock.com