Stockholm (HedgeNordic) – Nordic CTAs, as represented by the NHX CTA Index, ended the first half of 2018 on a negative note, posting a net loss of 2.1%, thereby outperforming the major industry benchmark SG CTA Index (-4.7%) and performing in line with the Barclay CTA Index (-2.0%). The slight loss for the index during the period masks significant swings and high dispersion among managers. February proved to be the decisive month following a volatility spike that took many by surprise.

Nordic CTAs, in line with the industry, ended 2017 with a string of monthly gains, helping to weather what was otherwise another year of lackluster performance. The gains continued into January 2018 but were then abruptly ended in February as a sudden volatility spike made many markets reverse simultaneously, causing significant losses for the industry.

The February move was all but usual. In just a matter of days, US stock markets erased gains that had been built-up over the last three to four months going into the month. The market turbulence also made the US dollar strengthen significantly following a longer period of weakness, in energy markets, the price of oil fell sharply.

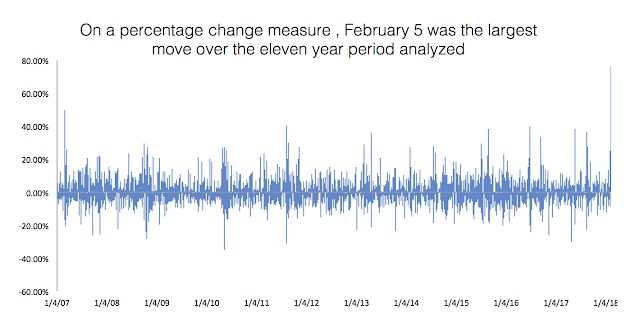

The VIX-index, a measure of market volatility and widely known as the fear index, had its biggest one day gain in eleven years on February 5, increasing by a whopping 77 percent. In retrospect, what caused the sudden trend reversals and the volatility burst was US data showing higher than expected wage inflation adding to concerns over coming interest rate hikes.

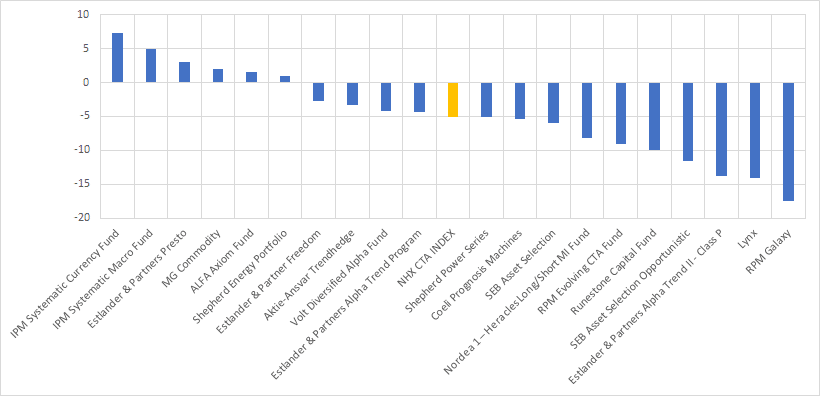

In their February market commentary, Swedish CTA giant Lynx described the trend reversals in February as the sharpest and most loss-making ever experienced. The manager retreated 14,1 percent during the month recording its single worst monthly return since inception in 2000. Among other losers on the month were RPM Galaxy (-17.5%), Estlander Alpha Trend II (-13.8%) and SEB Asset Selection Opportunistic (-11.6%). The NHX CTA Index slipped 5.1%.

“The trend reversals in February were the sharpest and most loss-making ever experienced” – Lynx

Among managers that handled the month particularly well were the two funds from IPM where Systematic Currency added 7.3% and Systematic Macro gained approximately 5% while the short-term program from Estlander, Presto, advanced 3.1%. The relative value nature of IPM´s funds is a likely explanation to the relatively strong numbers over more traditional trend following strategies as employed by most CTAs.

Chart 1 – Nordic CTA performance – February 2018

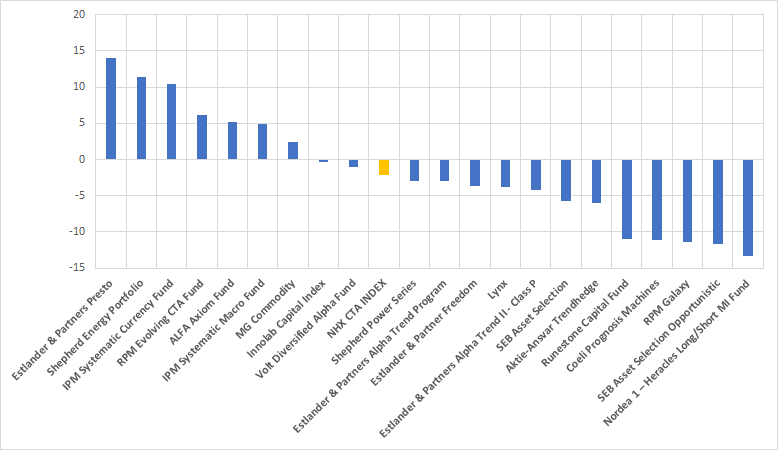

The performance dispersion in February generally filters through to the numbers for the first six months of the year. A fund that managed the first half well despite significant losses in February was RPM Evolving CTA Fund that ended the period with net gain of 6.1% despite losing 9.1% in February. Lynx also stayed clear of any major losses despite its massive drop in February.

Chart 2 – Nordic CTA performance – first half 2018

New CTAs Added to the NHX

During the first half of 2018, two new managers were added to the NHX CTA Index – Runestone Capital Fund and Innolab Capital.

Runestone Capital Fund is an absolute return fund started by two Nordic-born managers. The fund, managed out of London, was launched in May 2015 and trades VIX-related volatility instruments such as VIX futures, exchange-traded notes, and options.

Innolab Capital Index A/S, an alternative investment fund based on artificial intelligence managed by Danish management firm Innolab Capital ApS, has been added to the Nordic Hedge Index (NHX). Innolab Capital ApS has recently been granted permission by the Danish FSA to manage alternative funds, with the AI-powered fund targeting professional investors.

Picture: (C) donfiores – Shutterstock