Nordic FoHFs Off to a Slow yet Positive Start

Stockholm (HedgeNordic) – Nordic funds of hedge funds started off 2018 on a positive note, with more than two-thirds of the 23-member NHX Fund of Funds Index posting positive returns in January. The NHX sub-category gained 0.4 percent last month (100 percent reported).

However, international funds of hedge funds outperformed their Nordic counterparts by a noticeable margin in January. For instance, the Eurekahedge Fund of Funds Index, which tracks the performance of 465 investment managers who exclusively invest in single-manager hedge funds, advanced 2.1 percent (82.4 percent reported). Meanwhile, the HFRI Fund of Funds Composite Index was up 2.2 percent last month. The underperformance of Nordic FoHFs goes in parallel with the relative returns of the Nordic hedge fund industry against their global peers. The NHX Composite gained 0.8 percent in January, whereas the Eurekahedge Hedge Fund Index gained 2.1 percent.

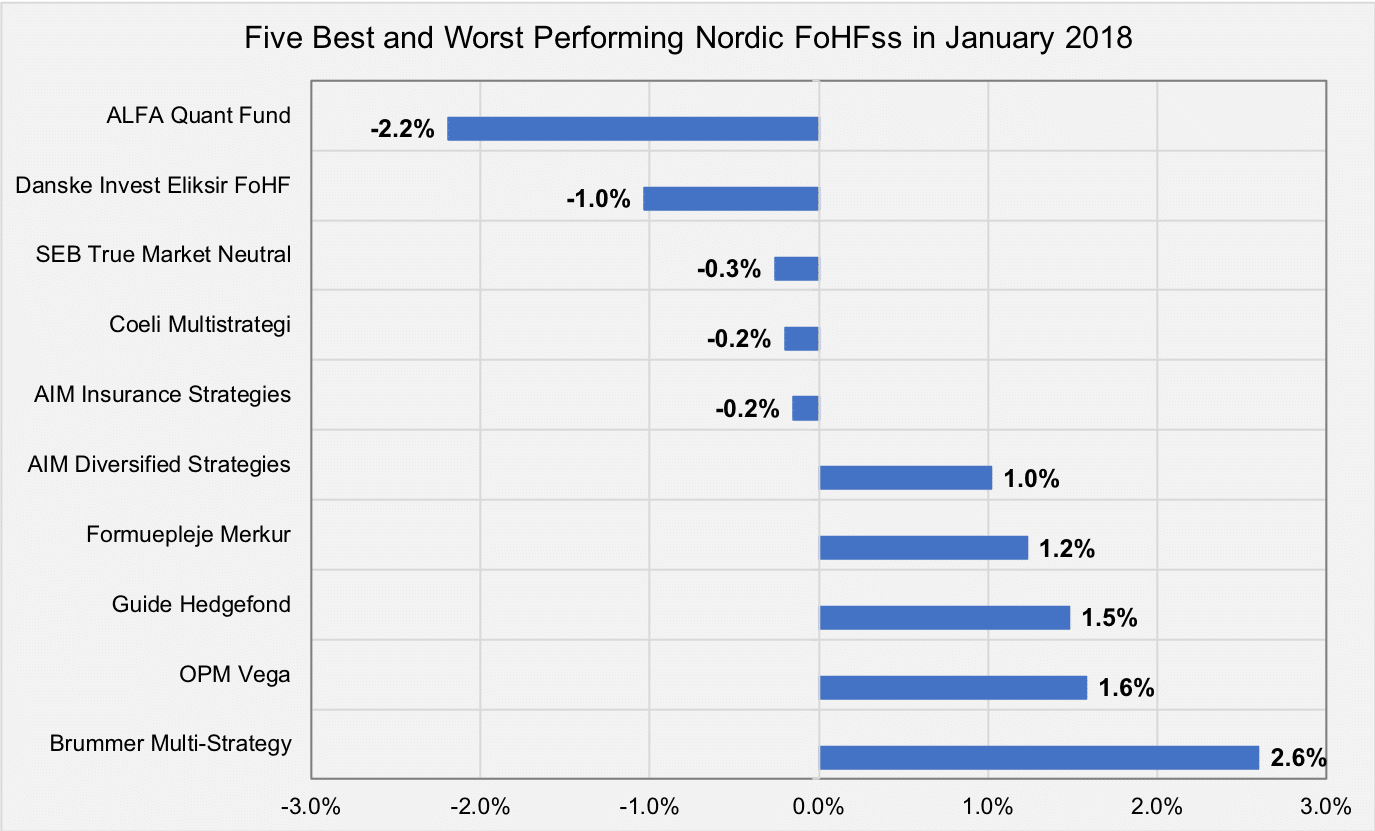

Brummer Multi-Strategy, which clinched the title of the best-performing Nordic FoHF in 2017, was the biggest gainer in the NHX Fund of Funds Index last month, advancing 2.6 percent. Six of Brummer’s underlying funds contributed positively to performance, with the largest positive contribution coming from long/short equity fund Manticore (6.9 percent).

OPM Vega, a fund under the umbrella of Stockholm-based Optimized Portfolio Management that invests in a pool of Nordic hedge funds, was up 1.6 percent in January, recording its best monthly return since the beginning of 2015. In a similar vein, Guide Hedgefond, a fund that predominantly invests in Swedish hedge funds, realised the best monthly result since its inception in January 2014, after gaining 1.5 percent last month.

Alfa Quant Fund’s run of bad luck continued into 2018 after the fund lost 11.6 percent in 2017. The multi-strategy fund that invests in Alfakraft Fonder’s single-strategy funds was down 2.2 percent last month. Danske Invest Eliksir FoHF, who invests in Finnish and foreign absolute return funds, posted a loss of 1.0 percent in January.

Picture © Ollyy – Shutterstock.com