This In-Depth series explores the universe of Emerging Markets, drawing on insights from allocators and fund managers experienced in both debt and equities within these markets. This series explores the benefits of investing in emerging markets, examines differences between hard currency emerging markets debt and local currency debt, and discusses equity investing in both emerging and frontier markets. Above all, this series emphasizes the advantages of investing in emerging markets and showcases diverse investment strategies designed to capture opportunities in this space.

Nordic Hedge IndexNHX

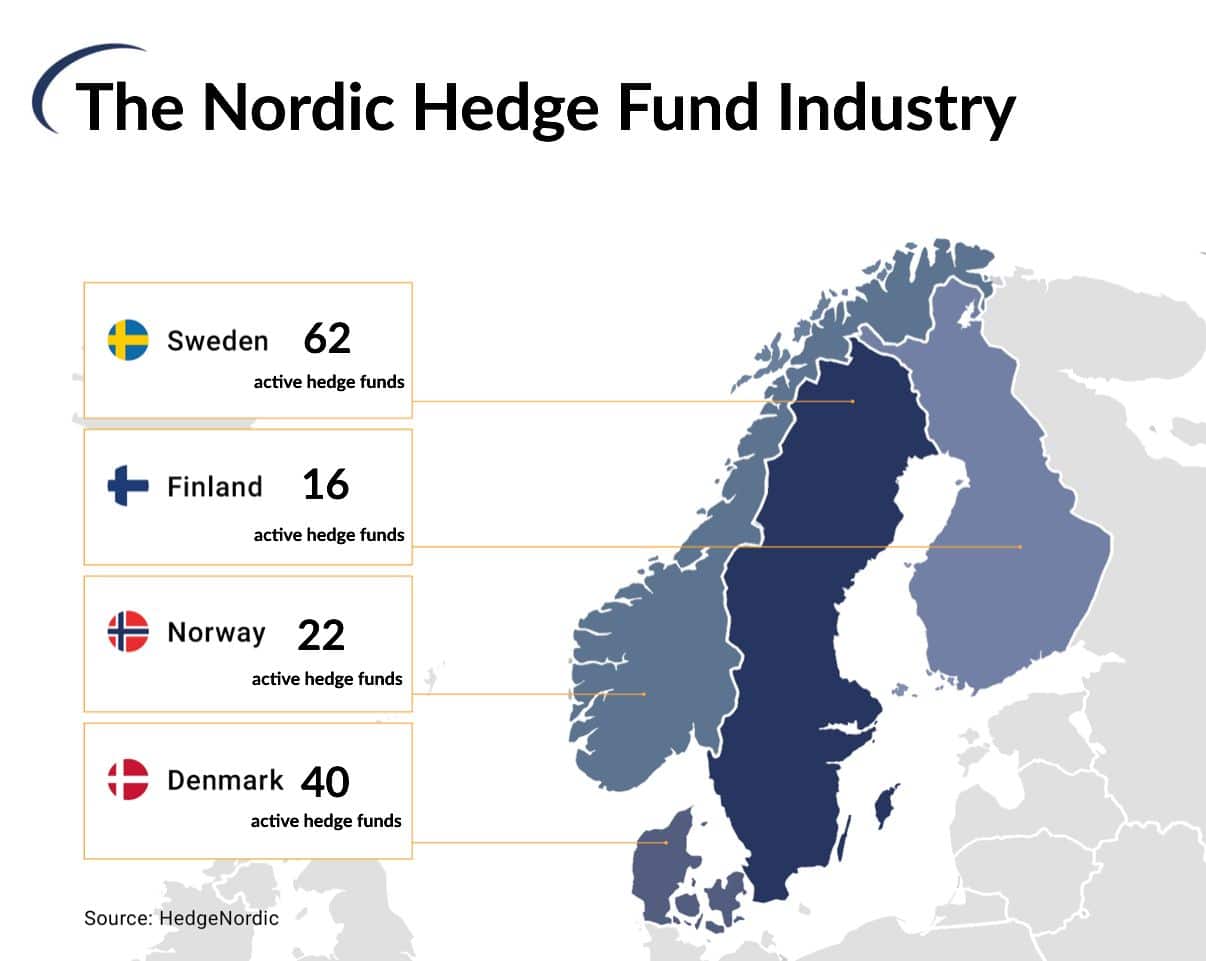

Your Single Access Point to the Nordic Hedge Fund Universe