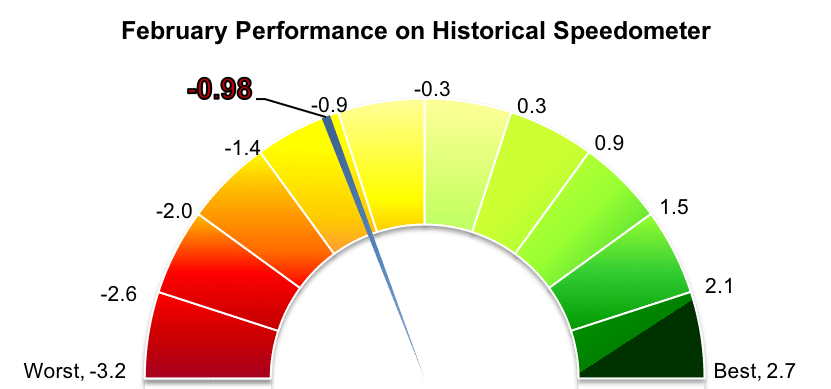

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds, as expressed by the NHX Multi-Strategy Index, tumbled 1.0 percent in February (97 percent reported), joining the other four NHX sub-categories in posting losses for the month. Roughly four-fifths of the 33 members included in the NHX Multi-Strategy Index ended the month in the red, with the index falling 0.4 percent in the first two months of 2018.

However, Nordic multi-strategy hedge funds performed in line with international indices tracking similar investment vehicles. For example, the Eurekahedge Multi-Strategy Hedge Fund Index, an equally-weighted index of 269 global multi-strategy funds, shed 1.1 percent last month (65 percent reported as of March 21), bringing the year-to-date performance to 0.7 percent. The Barclay Multi Strategy Index retreated 1.2 percent, an estimated performance based on reported data from 99 funds. The Barclay index was up 0.1 percent in the first two months of the year.

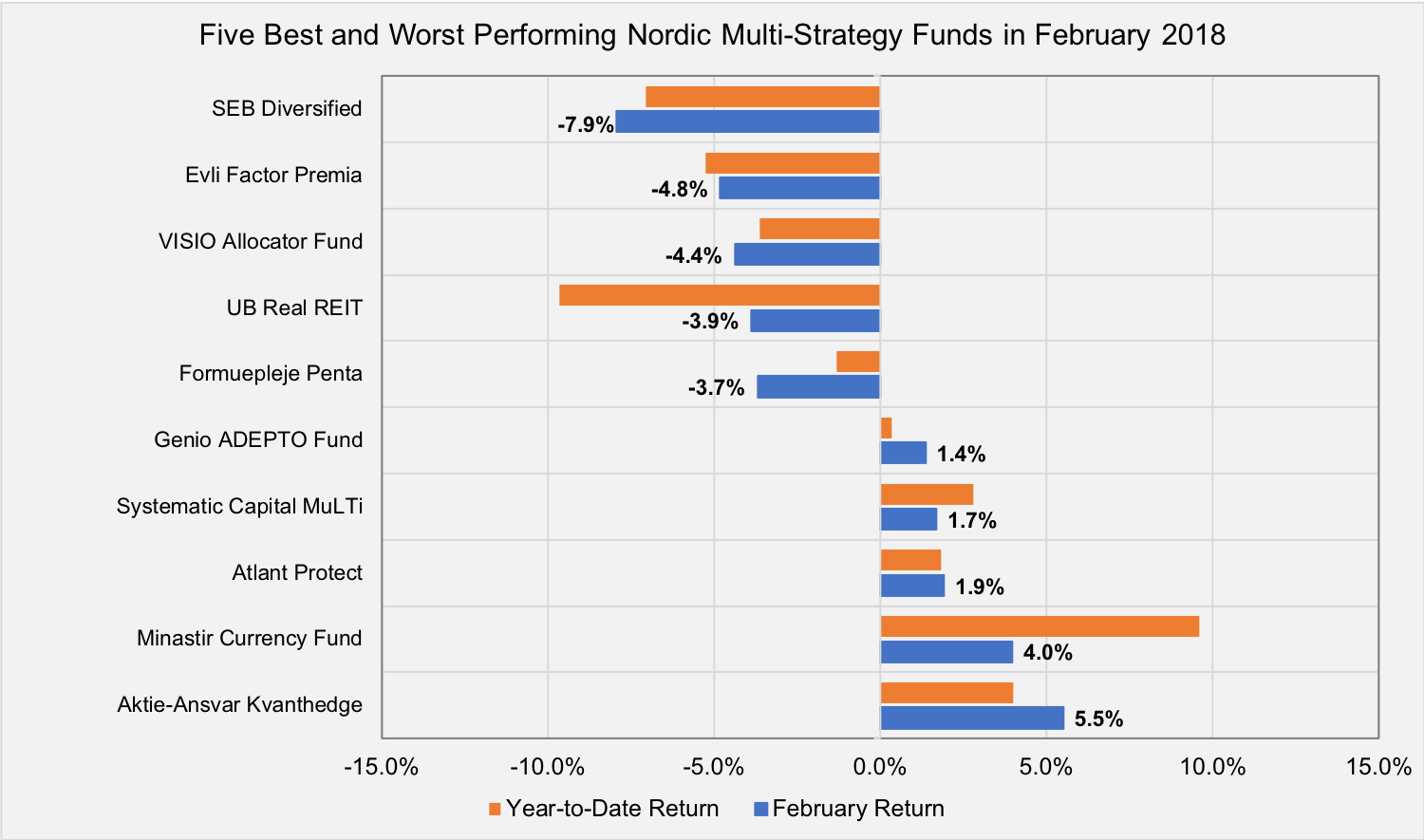

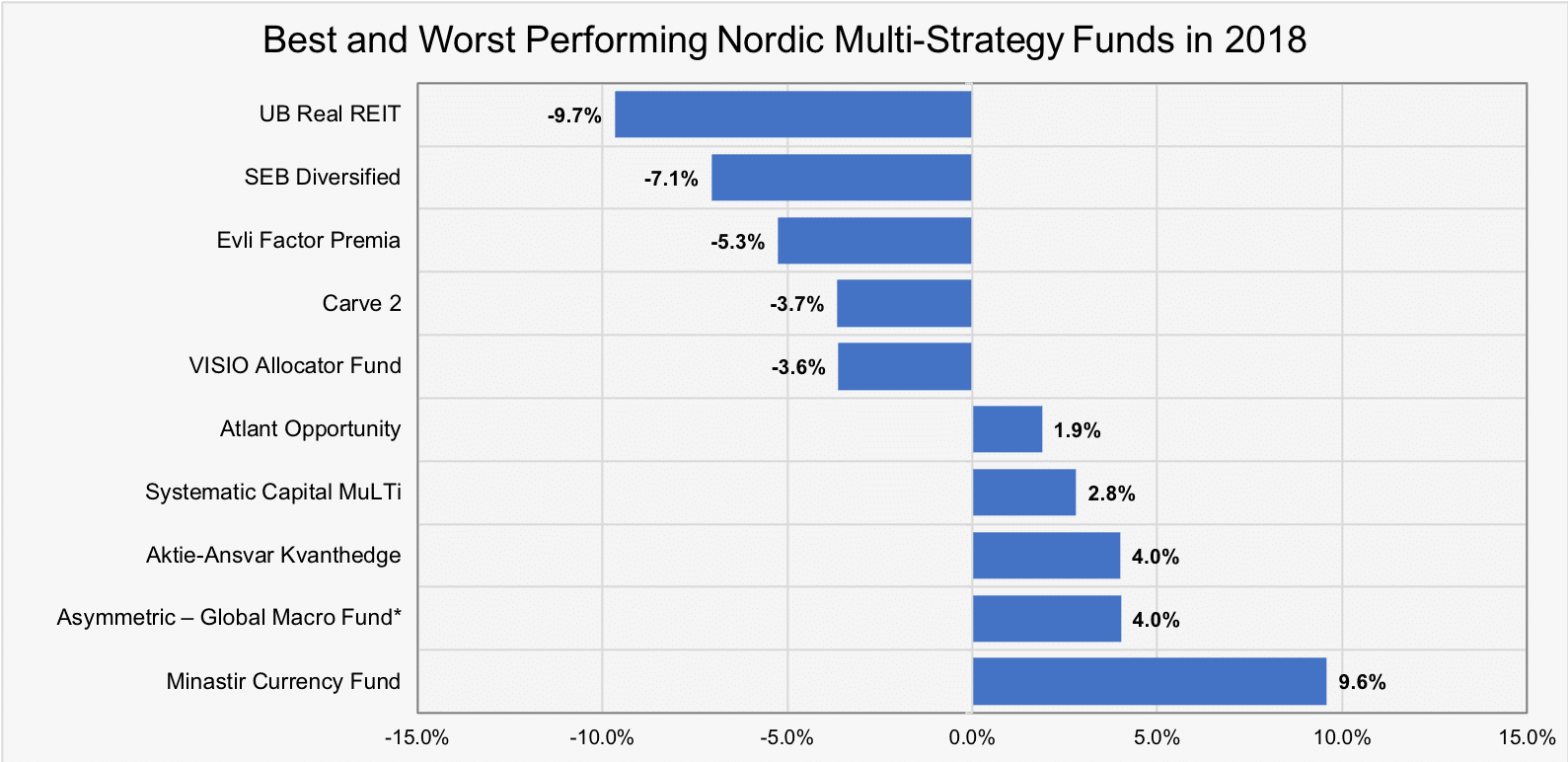

Aktie-Ansvar Kvanthedge, a hedge fund employing systematic trading strategies in equity, fixed-income and currency markets, gained 5.5 percent in February (up 4.0 percent YTD), securing the title of the best-performing multi-strategy fund.

Minastir Currency Fund, a directional hedge fund that takes long and short positions in currencies, was up 4.0 percent last month, after recording its biggest monthly gain ever in the first month of 2018 (up 9.6 percent YTD). Atlant Protect and Systematic Capital MuLTi advanced 1.9 percent and 1.7 percent, respectively (up 1.8 percent and 2.8 percent YTD). Genio ADEPTO, a collection of quantitative strategies running on global futures and equity markets, gained 1.4 percent last month (up 0.3 percent YTD).

*Performance figures for February not reported.

*Performance figures for February not reported.

After posting two consecutive years of strong performance, multi-strategy hedge fund SEB Diversified recorded its worst monthly performance last month. The fund was down 7.9 percent in February, bringing the 2018 performance to a negative 7.1 percent. Evli Factor Premia and VISIO Allocator Fund plunged 4.8 percent and 4.4 percent, respectively (down 5.3 percent and 3.6 percent YTD).

Picture © Isak55 – Shutterstock