Stockholm (HedgeNordic) – Danish credit hedge fund manager Capital Four has hard-closed its Credit Opportunities Fund as of the end of February, Bloomberg reports.

The firm, which has previously communicated a soft-close of the strategy, said “higher than expected commitments into the fund” has had the fund reaching the hard-closing level of EUR 500 million in February.

According to Bloomberg, the fund had a positive return in February and was up 0.78 percent in January, which has also been reported by HedgeNordic.

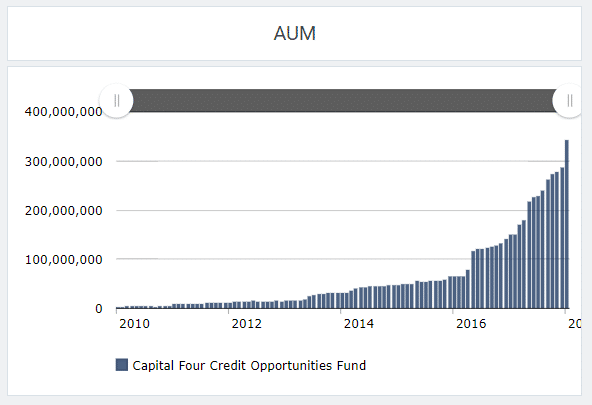

The announcement of the soft closing of the fund was covered by a Hedgenordic article earlier this year. According to AuM data reported to the HedgeNordic database, the fund has seen assets gaining more than fivefold since the start of 2016. The latest reported number in February 2018 was EUR 341 million.

Chart. Capital Four Credit Opportunities Asset Growth

Picture: (c) By-Bennian-shutterstock