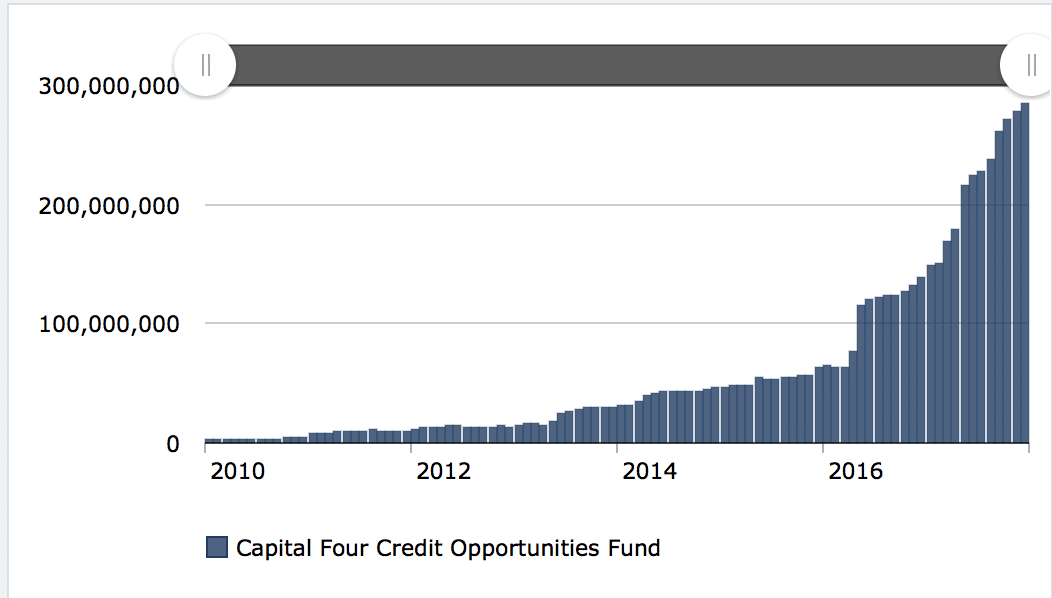

Stockholm (HedgeNordic) – In a send-out to investors, Danish Capital Four today announced it would be soft closing their Capital Four Credit Opportunities Fund to new investors. as the flow of subscriptions has led the fund to grow to Eur 350m by end of January 2018, reaching capacity restrictions.

In their email they write: “At Capital Four we monitor strategy capacity closely and take actions (soft closing) if a strategy grows too fast or is too high in volume. Past actions (closing HY strategy in 2011 and open it again in 2012) have confirmed, that our clients benefit by this long-term focused corporate strategy.”

The manager will, therefore, recommend to the board of fund to soft-close the vehicle for new investors by end of February.

According to data from HedgeNordic, the fund was up 6.4% in 2017, averaging 12,8% in returns since its inception in 2010.

Picture: (c) By-Bennian—Shutterstock.com