Stockholm (HedgeNordic) – CTA-strategier har historisk visat sig leverera stark avkastning i tider av hög riskaversion och fallande aktiemarknader, under turbulensen i augusti bidrog däremot CTAs negativt, divergensen mellan individuella förvaltare var ovanligt stor.

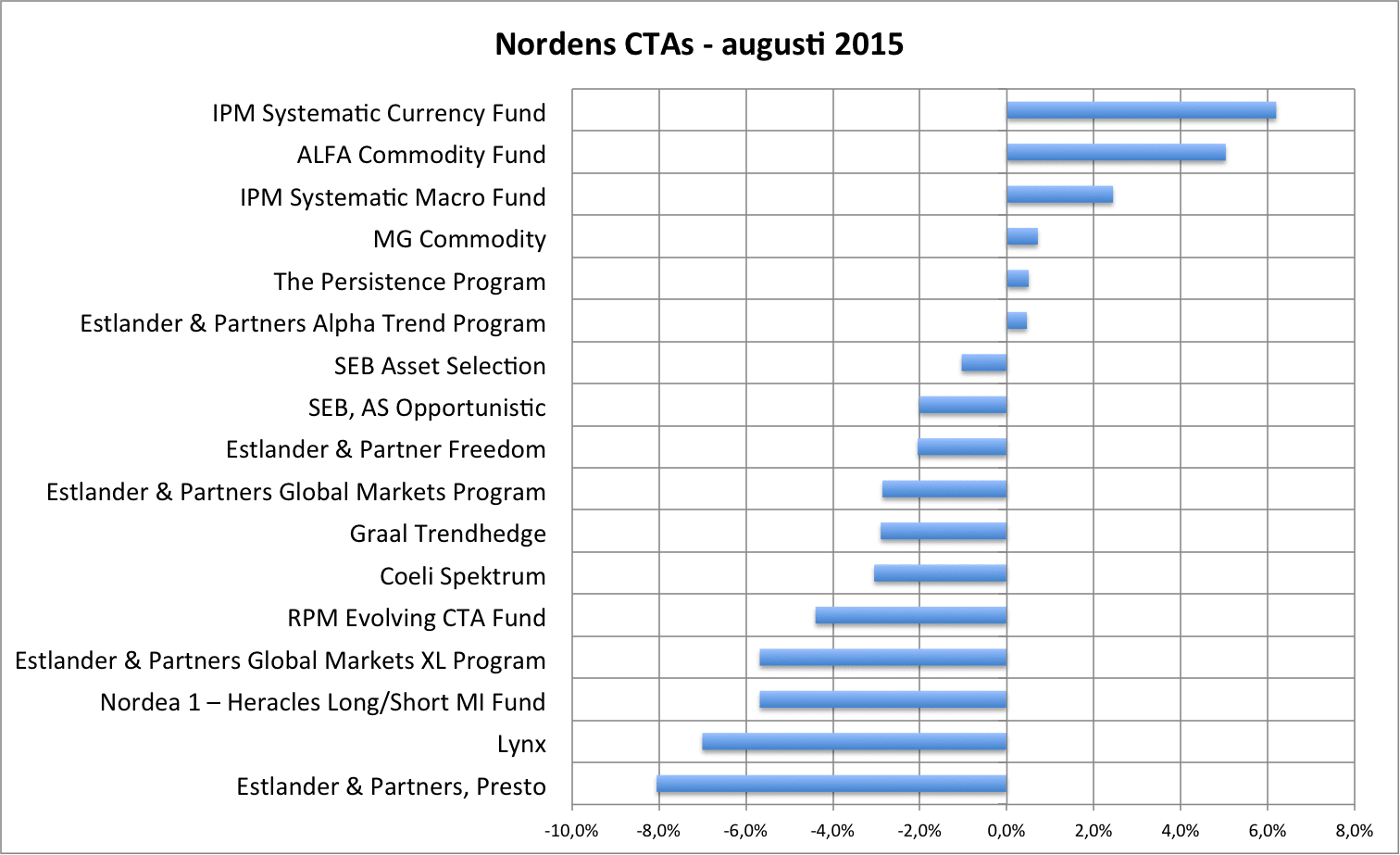

En överblick av de program som finns listade i den Nordiska hedgefond-databasen NHX (se nedan) visar att skillnaden mellan den bäst och sämst presterande förvaltaren uppgick till över 14 procentenheter.

Den stora förloraren under augusti var Lynx med en nedgång på 7 procent. Därmed är förvaltaren ned med ungefär lika mycket på året. Andra förlorare under månaden var Nordea Heracles, RPM Evolving och Coeli Spektrum.

Bland de positiva inslagen märktes IPMs två fonder Currency och Macro samt Alfa Commodity Fund.

Bild: (c) seewhatmitchsee – shutterstock.com