Sofia/ Stockholm (HedgeFonder.nu) – Bulgaria has pulled itself out of recession on the back of strong growth in exports; however, domestic consumption has remained weak and the government has persisted in its austerity. The Bulgarian government remains among the most prudent spenders in the EU, despite increasing pressure on the budget since 2008. The budget deficit fell from 4.7% in 2009 to 2.1% in 2011. Cautious fiscal policy over the last decade has left Bulgaria with a government debt to GDP of 16.2%, among the lowest in the EU.

Fiscal discipline and low debt levels have been achieved despite low taxes. Currently, taxes in Bulgaria are among the lowest in Europe. Bulgaria offers 0% tax on capital gains for transactions in securities on a regulated market; 10% flat corporate income tax, currently among the lowest in the European Union; 10% flat personal income tax; 5% tax on dividends for individuals. The state relies mostly on the 20% VAT and import duties for most of its revenues. As imports and consumption has fallen in recent years, the budget was strained; however, the government has remained firmly committed to fiscal discipline

Bulgarian banking system has remained stable, well capitalized and liquid throughout the global financial and economic problems in the recent years due to the conservative policy of the Bulgarian National Bank. Total capital adequacy ratio was 17.75% in September 2011, up from 17.48% in December 2011, well above the regulatory minimum of 12% in Bulgaria and 8% in the EU. None of the banks that operate in Bulgaria has needed any state aid since the beginning of the crisis. Bulgaria was expected to join the Euro in 2013 but enthusiasm for the euro has cooled recently due to the turmoil in the Eurozone. Bulgarian Lev is pegged to the Euro and the peg is likely to remain rock solid for years due to strong macro fundamentals, wide popular support and the central bank’s massive EUR 13.35bn FX reserve.

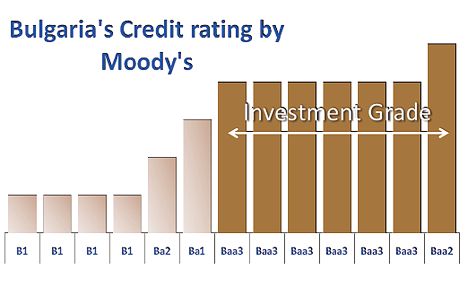

In 2011 Moody’s raised Bulgaria’s rating to Baa2 (stable outlook) taking into consideration the low debt burden, the small budget deficit, the improved institutional capacity and the strong liquidity that protects the economy from regional volatility. Bulgaria remained one of the few countries during this period of financial turmoil to have its credit rating increased.

(Chart 1. Bulgaria’s credit rating 1996 – 2011)

The Greek debt crisis has had no negative impact on the Bulgarian economy and actually it has brought a positive effect as there has been a noticeable inflow of Greek capital. A number of Bulgarian banks have reported a sharp increase in deposits from Greek citizens and a spokesperson for the central bank has confirmed this. Greek businesses have also been moving north, attracted by the 10% corporate income tax, a far better overall business climate and a cheaper and well-educated labour force.

Capital Market Overview: Macro Stability vs. Market Instability

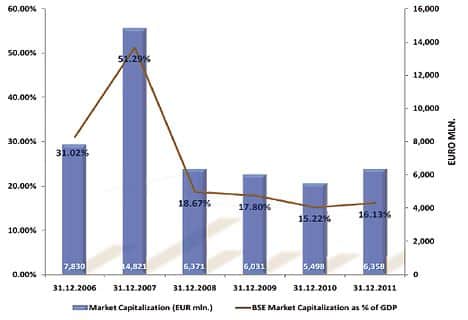

BSE market capitalization and market cap/GDP ratio reached their peaks in 2007 as a result of the increased number of local and foreign investors, higher market prices of the Bulgarian public companies and improving business environment in the country. However, the world financial and economic crisis has led to a sharp decrease in the indicators of the stock exchanges all over the world, incl. Bulgaria. Market capitalization and market cap/GDP ratio decreased by nearly 60% between 2007 and 2011.

(Chart 2: Total market cap & Total market cap as % of GDP)

Strong macroeconomic fundamentals have done little to attract investors’ interest, to date. Institutional investors, both foreign and domestic, stay aside of the market due to its lack of liquidity. Thus, the market has been left to unsophisticated retail investors. This lack of institutional interest created pockets of deep value in several sectors. Managements in a number of public companies have been quicker in recognizing the value in their stocks and moved to buy-back own stock promptly.

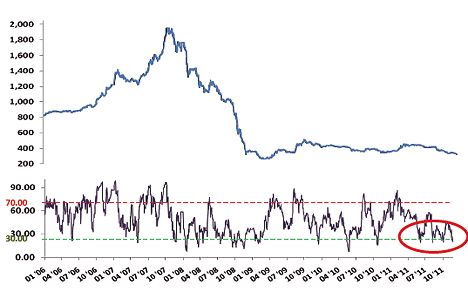

Relative Strength Index

At the end of Sept. 2011, SOFIX was some 81% lower than its peak levels at the end of 2007. On the whole, the Bulgarian market lagged behind the pace of recovery of the remaining markets in Central and Southeastern Europe in 2009 and 2010. That was also among the reasons for the relatively small decrease of SOFIX in 2011 in comparison with other regional markets. As it can be assumed from the RSI trend since the beginning of 2011, the market has gained stronger resistance levels; however, the RSI retained neutral and oversold territory. From quantitative point of view, the market currently exhibits continuous attractiveness with levels of the RSI below 30.

(Chart 3: RSI of SOFIX 1996-2011)

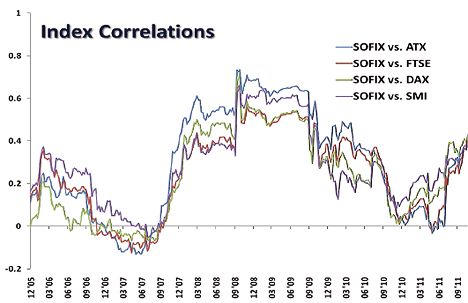

Correlation Analyses

The Bulgarian capital market allows for excellent diversification benefits. The decoupling of SOFIX from ATX, DAX, FTSE and SMI that commenced in the second half of 2009, offered attractive diversification benefits during 2010 and 2011. With a current correlation in the 0.4 range, the Bulgarian capital market continues to offer excellent equity diversification benefits. With a view to the continuing critically high intermarkets’ correlation in Europe, the Bulgaria’s blue chip index SOFIX has retained diversification attractiveness during the years.

(Chart 4: Index Correlations 2005-2011)

Investment Highlights: Response to Lower Valuations

Shares Repurchase

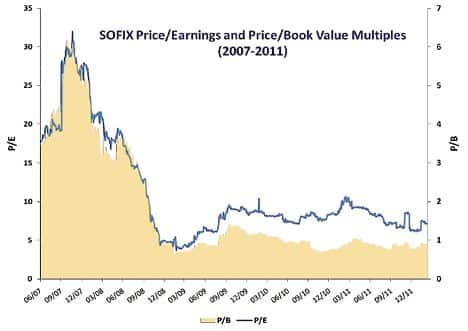

Currently, the Bulgarian blue chip price multiples are attractive with SOFIX P/E values at nearly 8 and SOFIX P/B values below 1. In comparison, the values at the end of 2007 were as follows: P/E = 32 and P/B = 6.5.

(Chart 5: P/B & P/E of SOFIX 2007-2011)

While investors ignored low valuations, managements did not. A number of companies moved in to take advantage of the low valuations in their own stocks.

Anecdotal Evidence

The Management of Mel Invest REIT (BSE:6A7), a large farmland owner, made a tender offer to buy-back minority shareholders at a significant discount to fair value. Surprisingly a large number of minorities accepted the offer, apparently glad to have a way out at any price. Managements at other farmland owners moved in to buy-back shares. Exporters such as the starter-battery producer Monbat (BSE:5MB), the hydraulics manufacturer M+S Hydravlic (BSE:5MH) and the pharmaceuticals company Sopharma (BSE:3JR) have also initiated buy backs.

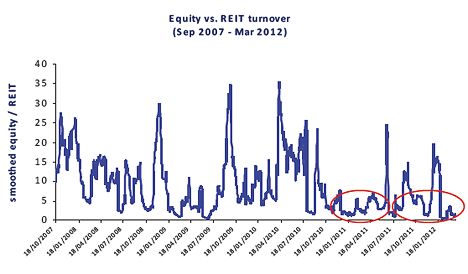

Voluntary Liquidations of REITs

Real Estate Investment Trusts (REITs) have always been among the most prominent stocks in Bulgaria. By examining the ratio of common equity turnover to REITs turnover, smoothed for 22 trading sessions, it is clear that during 2011 and in 2012 as well investors have refocused their interest in REITs. The perceived mis-pricing of the REITs’ market value and the underlying assets have driven some of the REITs to request voluntary liquidation, which – on its turn – has triggered arbitrage trading on the market price vs. the assumed underlying assets price.

Anecdotal Evidence

Farmland REITs have long been among the most undervalued companies. Underperformance continues despite strong soft commodity prices and robust demand for farmland from the local farmers. The Management of ELARG REIT (BSE:4EC), the third largest owner of farmland in Bulgaria, has announced its intentions to liquidate all assets in 2012 and distribute proceeds to shareholders. ERG Capital – 1 REIT (BSE:4EA) and ERG Capital – 2 REIT (BSE:4ER) followed shortly after, making similar voluntary liquidation announcements. The reason quoted was a huge discount of stock price to fair value.

Data sources:

www.bse-sofia.bg

www.minfin.bg

Authors:

Georgi I. Bylgarski, FRM, CFA, CAIA, Member of the Board of Directors – Bulgarian Stock Exchange – Sofia

Svetoslav Tassev, Equity Research Analyst – KBC Securities N.V. – Bulgarian Branch

Iliyan Dimitrov, Senior Expert Bulgarian Stock Exchange – Sofia

Petar Kemalov, Senior Expert Bulgarian Stock Exchange – Sofia

Disclaimer:

The article is set forth for informational purposes only. By reading it, all viewers acknowledge that (i) this material neither constitutes an offer to sell, nor a solicitation of an offer to buy, the securities described, (ii) no recommendation is made concerning the securities described, and (iii) it is unlawful to offer to sell or to solicit an offer to buy the described securities unless the FSC is duly informed.

The expressed thoughts, the discussion held and the presentation itself, represent only the personal opinion of the authors, and could not be considered binding for the current employer thereof, as well as for former employers thereof.

The authors may possess investments, or consult clients holding investments, in some of the instruments as analyzed and discussed herein.